Filing for Chapter 7 bankruptcy in Kentucky requires careful attention to your tax obligations. Many filers don’t realize that tax returns play a critical role throughout the bankruptcy process, from determining eligibility to protecting assets after discharge.

This guide explains the chapter 7 tax return requirements you need to know before, during, and after your Chapter 7 case in Kentucky.

Unsure if your tax situation affects your Chapter 7 eligibility? Contact O’Bryan Law Offices for a free consultation and get answers specific to your Kentucky case.

Why Tax Returns Matter in Chapter 7 Bankruptcy

📋 Tax returns serve multiple purposes in your bankruptcy case. They verify your income for the means test, help the trustee identify potential assets, and ensure you’re in compliance with federal bankruptcy law.

The bankruptcy court and your assigned trustee will scrutinize your tax documents closely. Failing to provide accurate returns can delay your case or result in dismissal.

According to IRS Publication 908, debtors filing under Chapter 7 must file all applicable federal, state, and local tax returns that become due after a case commences. This requirement isn’t optional, and failing to comply can convert your case to another chapter or lead to outright dismissal.

Tax Returns You Must Provide to the Trustee

When filing Chapter 7 bankruptcy in Kentucky, you must submit copies of your most recent federal and state tax returns to your trustee. Most trustees require two years of tax returns to verify your reported income and identify potential assets.

The U.S. Bankruptcy Court for the Western District of Kentucky requires debtors to submit these documents at least 14 days before the 341 Meeting of Creditors. Missing this deadline can postpone your meeting and extend your case timeline.

The Two-Year Tax Filing Requirement

⚖️ You cannot file for Chapter 7 bankruptcy until you’ve filed tax returns for the past two years. This is a firm requirement under federal bankruptcy law.

If you haven’t filed your taxes, you’ll need to complete them before proceeding. Kentucky offers free tax preparation services through the Kentucky Department of Revenue for qualifying residents.

| Tax Document | When Required | Who Reviews It |

|---|---|---|

| Federal returns (2 years) | Before filing bankruptcy | Trustee |

| Kentucky state returns (2 years) | Before filing bankruptcy | Trustee |

| Current year return (if filed) | At 341 Meeting | Trustee |

| Proof of filing extensions | If applicable | Court and Trustee |

Tax Returns and the Means Test

The Chapter 7 means test determines whether your income is low enough to qualify for liquidation bankruptcy. Your tax returns provide critical documentation for this calculation.

📊 Kentucky’s median income thresholds are updated periodically. For cases filed between May 15, 2025 and October 31, 2025, Kentucky’s median income is $57,764 for a single person, $69,371 for two people, $84,183 for three people, and $105,955 for a family of four. If your income falls below these thresholds, you automatically pass the means test.

One common mistake involves incorrectly reporting taxes on the means test. You can only deduct your actual tax due, not the amounts withheld from your paychecks. If you receive large refunds each year, your withholdings may overestimate your tax deduction.

What Happens to Your Tax Refund in Chapter 7?

This question concerns many Kentucky filers. Your tax refund is considered an asset in bankruptcy, and whether you keep it depends on timing and exemptions.

How Tax Refunds Are Treated in Chapter 7

💰 Your tax refund is considered property in bankruptcy, similar to money in a bank account. Tax refunds earned before your bankruptcy filing date become part of your bankruptcy estate, and the trustee can claim non-exempt refunds to pay creditors.

Kentucky is one of 20 states that allows filers to choose between state and federal bankruptcy exemptions. Federal exemptions are typically more generous for protecting tax refunds and cash assets.

Here’s how exemptions can protect your refund:

- Wildcard exemption: Under federal law (effective April 1, 2025), you can protect $1,675 plus up to $15,800 of any unused homestead exemption, for a potential total of $17,475.

- Cash exemption: This covers money in bank accounts, which may include recently deposited refunds.

- Spending the refund: If you spend your refund on necessary living expenses before filing, there’s no asset for the trustee to claim.

Ready to file Chapter 7 in Kentucky? Call O’Bryan Law Offices at (502) 339-0222 to speak with a board-certified bankruptcy attorney about your tax returns and exemptions.

Common Tax Refund Scenarios in Chapter 7

Understanding how different situations affect your refund can help you make informed decisions:

| Scenario | What Happens | Protection Strategy |

|---|---|---|

| Refund received before filing | Becomes cash asset in estate | Spend on necessities or claim exemption |

| Refund pending at filing | Part of bankruptcy estate | Claim wildcard exemption if available |

| Refund for post-filing income | Belongs to you, not estate | No protection needed |

| Large refund with no exemptions | Trustee may claim it | Adjust withholdings before filing |

Protecting Your Tax Refund: Strategic Options

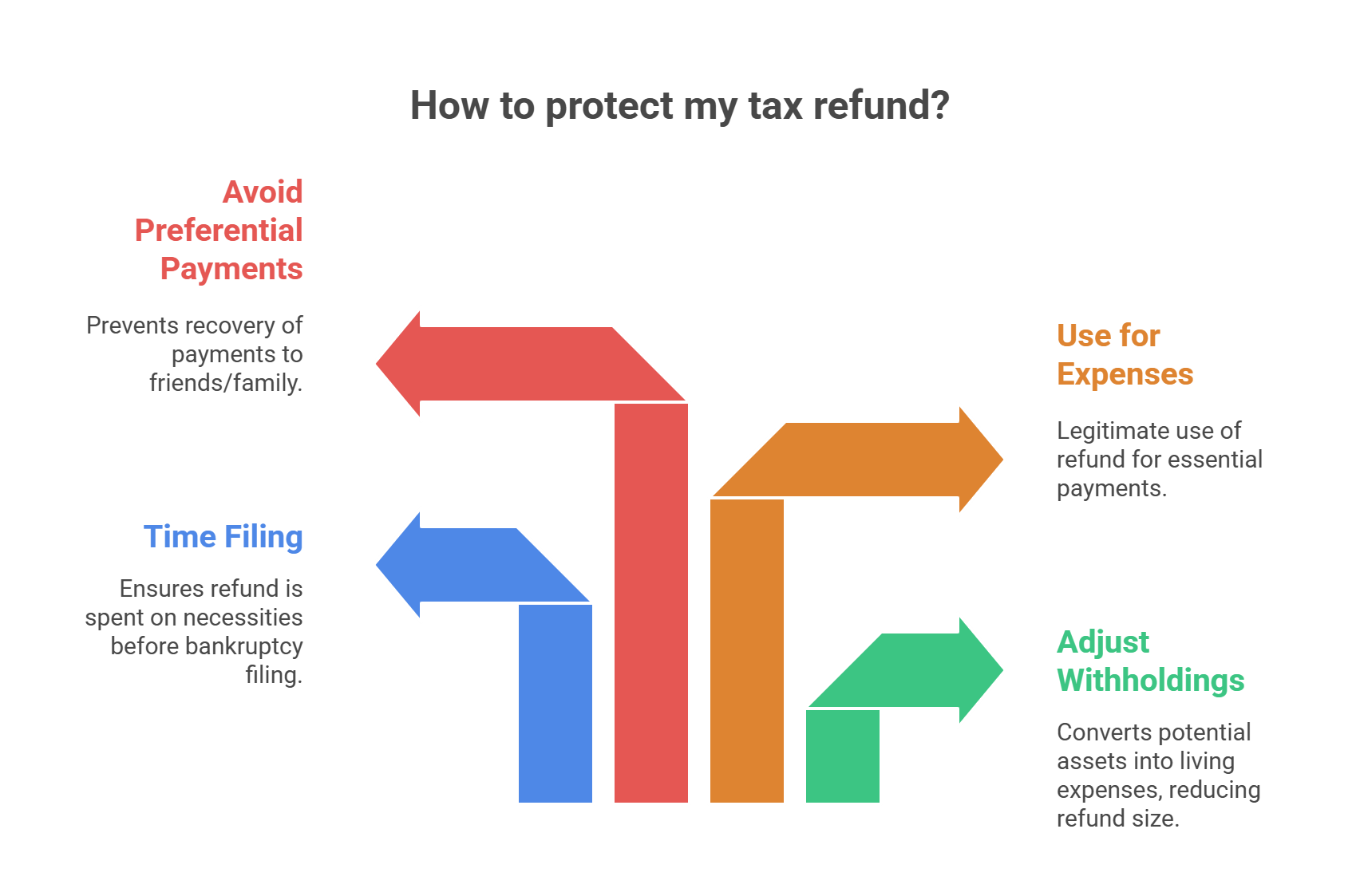

🛡️ Planning ahead can help you maximize what you keep:

- Adjust your withholdings: Reducing your exemptions so you receive more in each paycheck (rather than a large refund) converts potential assets into living expenses.

- Time your filing carefully: If you’ve already received and spent your refund on necessities, there may be no asset for the trustee to claim.

- Use refunds for legitimate expenses: Paying current rent, utilities, mortgage payments, or medical bills with your refund is acceptable.

- Understand preferential payments: Paying back friends or family members shortly before filing bankruptcy can create problems. The trustee may be able to recover these payments and redistribute them to all creditors.

Avoid these pitfalls:

- Paying debts to family members or friends (preferential payments)

- Paying multiple months of expenses in advance

- Purchasing luxury items

- Transferring money to others to hide assets

Tax Obligations During Your Bankruptcy Case

Once your Chapter 7 case begins, you must continue meeting all tax obligations. The Internal Revenue Service requires debtors to file or request extensions for all returns that become due during bankruptcy.

Failure to file returns during your case can result in dismissal or conversion to Chapter 7. You must also pay current taxes as they come due.

Can Income Taxes Be Discharged in Chapter 7?

Some income tax debts can be eliminated through Chapter 7 bankruptcy, but strict rules apply. The 3-2-240 rule determines eligibility:

| Requirement | Timeframe | What It Means |

|---|---|---|

| Return due date | 3+ years before filing | Taxes from recent years don’t qualify |

| Actual filing date | 2+ years before filing | Late-filed returns restart the clock |

| Assessment date | 240+ days before filing | Audit assessments need time to age |

Additionally, you cannot have filed a fraudulent return or attempted to evade taxes. The Kentucky Department of Revenue notes that while federal law stops most collection action during bankruptcy, most taxes survive the process.

Kentucky-Specific Considerations

📍 Kentucky residents benefit from the ability to choose between state and federal bankruptcy exemptions. For most Chapter 7 filers, federal exemptions provide better protection for tax refunds and cash assets.

The Kentucky Justice Online resource explains that married couples filing jointly can double their exemption amounts.

Kentucky has two federal bankruptcy court districts:

- Western District: Covers Louisville, Bowling Green, Owensboro, and surrounding areas. The Gene Snyder U.S. Courthouse in Louisville handles most filings.

- Eastern District: Covers Lexington, Northern Kentucky, and Eastern Kentucky. The U.S. Bankruptcy Court in Lexington serves this region.

Working with a Louisville bankruptcy lawyer familiar with local practices ensures compliance with district-specific requirements.

Documents You Need Beyond Tax Returns

Understanding chapter 7 tax return requirements is just one part of gathering your paperwork. You’ll also need:

- Income documentation: Six months of pay stubs and proof of other income sources

- Credit reports: From all three bureaus (Equifax, Experian, TransUnion)

- Asset records: Vehicle titles, property deeds, bank statements

- Debt documentation: Recent statements from all creditors

- Insurance and retirement: Life insurance policies with cash value, 401(k) and IRA statements

According to Kentucky Justice Online’s bankruptcy checklist, having these materials ready before filing prevents delays.

Credit Counseling and Debtor Education

Before filing Chapter 7, you must complete credit counseling from an approved agency. The U.S. Department of Justice maintains a list of approved providers for Kentucky.

Important: Your credit counseling certificate is only valid for 180 days. If you won’t be ready to file within that window, wait to complete counseling.

After filing, you must complete a debtor education course before receiving your discharge. Both courses typically cost between $15-$50 and can be completed online or by phone.

Common Tax-Related Mistakes to Avoid

🚫 These errors can derail your Chapter 7 case:

- Not filing required returns: You cannot proceed with bankruptcy until past returns are filed.

- Inaccurate income reporting: Discrepancies between your tax returns and bankruptcy schedules raise red flags.

- Including Social Security in means test income: Social Security benefits should be excluded from your means test calculation.

- Spending refunds improperly: Paying off favored creditors or buying non-necessities before filing creates problems.

- Forgetting state tax obligations: The Kentucky Department of Revenue must be notified of your bankruptcy filing separately.

Getting Professional Help

Learning how to file bankruptcy chapter 7 involves navigating complex rules that intersect tax law and bankruptcy law.

Kentucky’s civil legal aid programs, including Kentucky Legal Aid and the Legal Aid Society, offer free assistance to qualifying low-income residents. The University of Kentucky College of Law also provides pro bono bankruptcy assistance through its legal clinics.

A board-certified bankruptcy attorney can help you maximize exemptions, navigate means test complexities, address tax debts, and avoid costly mistakes that could delay or dismiss your case.

Bankruptcy Statistics: Why Many Kentuckians Seek Relief

Kentucky consistently ranks among states with higher bankruptcy filing rates. In 2024, the state had more than two bankruptcies filed per thousand residents, reflecting the financial challenges many families face.

Income loss remains the primary driver of bankruptcy filings nationwide, cited by approximately 78% of filers. Medical expenses and related issues also contribute significantly, affecting a majority of those who file.

Chapter 7 remains the most common form of personal bankruptcy, accounting for roughly 60% of all filings in 2024. The relatively quick timeline (typically three to six months from filing to discharge) makes it attractive for those seeking immediate debt relief.

Take the Next Step Toward Financial Relief

Filing Chapter 7 bankruptcy offers genuine relief from overwhelming debt. Understanding how tax returns fit into the process helps you prepare properly and avoid surprises.

📱 If you’re considering bankruptcy, gathering your tax returns is an important first step. Review your filing history, locate copies of recent returns, and assess whether any returns remain unfiled.

For personalized guidance, contact a Louisville bankruptcy lawyer who can evaluate your circumstances and explain your options.

FAQs

Do I need to file my taxes before filing Chapter 7 bankruptcy in Kentucky?

Yes. Kentucky bankruptcy courts require you to file all tax returns for the past two years before your Chapter 7 case can proceed. If you have unfiled returns, the Kentucky Department of Revenue offers free tax preparation services for qualifying residents.

Can I keep my tax refund if I file Chapter 7 in Louisville or Lexington?

It depends on the size of your refund and available exemptions. Kentucky allows filers to choose federal bankruptcy exemptions, which include a wildcard exemption of up to $17,475. Many Kentucky filers protect their entire refund using this exemption.

What happens to my Kentucky state tax refund in Chapter 7?

Your Kentucky state tax refund is treated the same as your federal refund. It becomes part of your bankruptcy estate if earned before filing. The trustee assigned to your case in either the Western District (Louisville) or Eastern District (Lexington) will review whether exemptions protect it.

How long do I have to provide tax returns to my Kentucky bankruptcy trustee?

You must submit your tax returns to the trustee at least 14 days before your 341 Meeting of Creditors. This deadline applies whether you file in Louisville, Frankfort, Bowling Green, Lexington, or any other Kentucky location.

Can I discharge Kentucky state tax debt in Chapter 7 bankruptcy?

Some Kentucky state tax debts can be discharged if they meet the 3-2-240 rule: the return was due more than 3 years ago, filed more than 2 years ago, and assessed more than 240 days ago. The Kentucky Department of Revenue stops most collection action during bankruptcy, but many taxes survive discharge.

What is the income limit for Chapter 7 bankruptcy in Kentucky?

For cases filed between May 2025 and October 2025, Kentucky’s median income limits are $57,764 for one person, $69,371 for two people, $84,183 for three people, and $105,955 for four people. If your income falls below these thresholds, you automatically qualify for Chapter 7.

Where do I file Chapter 7 bankruptcy in Kentucky?

Kentucky has two federal bankruptcy court districts. The Western District covers Louisville, Bowling Green, Owensboro, Frankfort, and surrounding counties. The Eastern District covers Lexington, Northern Kentucky, and Eastern Kentucky. You file in the district where you’ve lived for the majority of the past 180 days.