Chapter 13 Timeline

Chapter 13 Bankruptcy Timeline in Kentucky

Many people consider filing bankruptcy for credit card debt, medical debt, default mortgage payments, or other financial reasons. It’s no surprise that they want to know how long the process will take. Before diving into a bankruptcy filing, it’s important to have at least a basic understanding of whether or not you qualify, how the bankruptcy process proceeds, and how long you’ll have to commit. In the following sections, we outline the full Chapter 13 timeline and walk you through the process of achieving lasting debt relief.

At O’Bryan Law Offices, our bankruptcy professionals have extensive experience helping Kentucky and Indiana residents take back control of their lives. If you have secured and unsecured debts weighing you down with no end in sight, bankruptcy could be the escape you need. With the benefits of bankruptcy protection, you can get some much-needed financial breathing room while you work on fulfilling obligations to your creditors. For more information about how bankruptcy can help you, please schedule a free consultation with us. Call our office today at 502-339-0222.

How Long Does Chapter 13 Bankruptcy Take?

Generally, Chapter 13 bankruptcy filings can take anywhere from 3 to 5 years in total. The duration of your Chapter 13 case will depend on a few factors, including your income and the amount of time you need to complete the repayment plan. With the help of your bankruptcy attorney, you will work with your creditors and bankruptcy trustee to determine the length of the repayment period.

Who Can File Chapter 13?

Chapter 13 differs from Chapter 7 in a major way. While Chapter 7 does not require you to repay your creditors, you will repay your creditors, at least partially, in Chapter 13. Because of this, Chapter 13 filers must have a regular source of income. If an individual or married couple takes the Chapter 7 means test and makes too much money, they must file Chapter 13.

The means test determines whether or not you can afford to repay your creditors. If not, you will file Chapter 7. If you can afford to make payments, you will file Chapter 13. However, the benefits of making these payments is the ability to keep your property, such as your home and vehicle. In Chapter 7, there is a possibility that some of your property will be liquidated to repay your creditors.

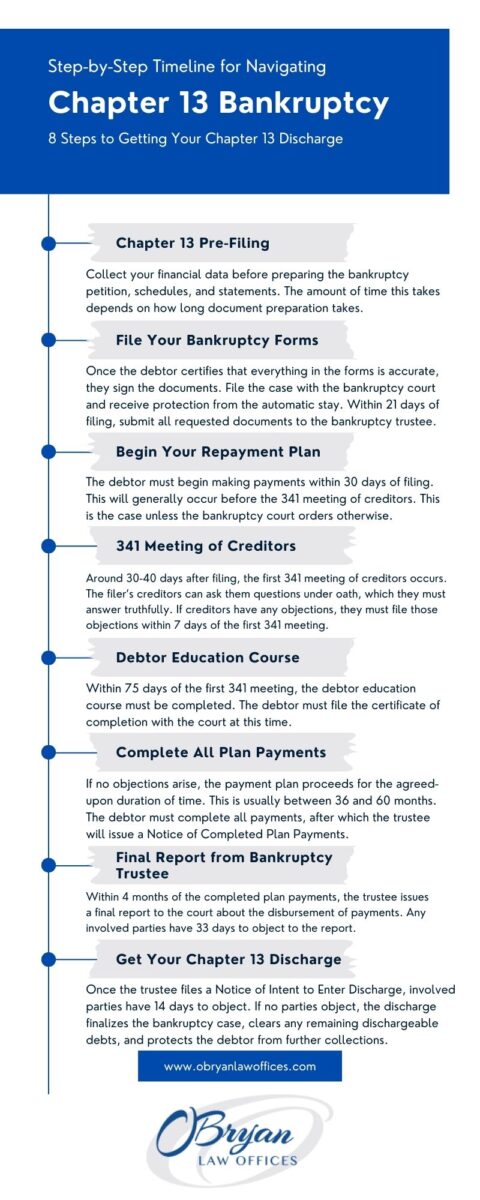

Full Chapter 13 Bankruptcy Timeline

At first, the Chapter 13 process may seem intimidating. However, it is actually more straightforward than many filers realize. In the following sections, we outline the major steps that Chapter 13 filers must complete before receiving their Chapter 13 discharge.

Chapter 13 Pre-Filing

Before submitting your bankruptcy petition to the bankruptcy court, there are certain steps you and your attorney must take. First, you must complete a credit counseling course. You will need the certificate of completion in order to begin your bankruptcy case.

Documents Needed to File Chapter 13 Bankruptcy

You and your attorney must gather many financial documents, as well as copies of your credit reports, a list of all your debts, and a list of all your creditors. The important financial documents you must gather include the following.

- Tax returns from the past 4 years

- Bank account statements from the past 6 months

- Proof of income or pay stubs from the past 6 months

- Recent real estate tax bills and mortgage statements, if applicable

- Appraisals of any real estate you own

- Lease agreement, if applicable

- Recent brokerage or retirement account statements

- Recent car loan statements

These documents are important because they help you, your lawyer, the bankruptcy trustee, and your creditors get a better picture of your current financial situation. These documents make it much easier to fill out your bankruptcy forms in a timely manner.

Signing and Filing Documents

Once you have completely filled out your bankruptcy petition and all statements and schedules, you should meet with your bankruptcy attorney to review them for accuracy. Then, after you verify that the information on those documents is true and accurate, you must sign every document. Either that same day or the next day, you will submit these documents along with your bankruptcy petition to the bankruptcy court.

As soon as you file, the automatic stay goes into effect. The automatic stay protects you from the following collection activities.

- Creditor harassment

- Beginning or continuing court cases against the debtor

- Foreclosing on a property

- Repossessing a vehicle or other collateral

- Creating or enforcing a lien against a property

- Wage garnishment

If a creditor continues to attempt collection after the automatic stay is in effect, you may be able to sue them in court.

Sending Documents to Bankruptcy Trustee

After the court has assigned a bankruptcy trustee to your case, you must send all of your documents to the trustee for them to review. They will likely request additional documents, which you also must provide. When requesting these documents, the trustee will likely send a letter either to you or your attorney.

You must send these documents early enough so that the trustee receives them no later than 7 days before the 341 meeting. Your trustee may have an earlier deadline, so ensure that you know how much time you have to submit your documents.

Chapter 13 Repayment Plan Begins

Within 30 days of filing your Chapter 13 bankruptcy petition, you will make your first monthly payment for your payment plan. Bankruptcy trustees usually require you to make this payment through a certain method, so be sure to verify this before submitting your payment.

Although not every filer has to make their first payment before the 341 meeting, it is usually the case that they have to. This is because the deadline for the first payment usually falls before the first 341 meeting. The court will usually indicate otherwise.

341 Meeting of Creditors

The first 341 creditors meeting will occur around 30-40 days after filing. This meeting gives your creditors the opportunity to ask you questions about your finances and the bankruptcy documents you submitted. However, in most cases, creditors will not attend the meeting.

As the debtor, you are required to attend the 341 meeting. Generally, creditors will only show up if they suspect the debtor has lied or misrepresented certain information. Your bankruptcy trustee will also ask you questions under oath, so make sure that you are completely truthful with your answers. If the meeting ends up being a bit long, it may be continued to another date.

Specifically, the Bankruptcy Code requires that the first 341 meeting occur no sooner than 21 days after filing and no later than 50 days after filing. It is during this meeting that the repayment plan will be discussed and proposed.

Creditor Proofs of Claim

Your creditors must submit proofs of claim to the bankruptcy court after you file your case. A proof of claim form serves to show the court that the debtor owes a certain amount of debt to the creditor. If a creditor fails to submit a proof of claim, they may be barred from receiving payments in the Chapter 13 repayment plan.

Creditor Objections

If a creditor objects to the proposed repayment plan, they must submit an objection to the plan within 7 days of the first 341 meeting. Rarely, the court may extend the deadline for objections.

Debtor Education Course

The bankruptcy filer must complete a debtor education course, also called a financial management course. After completion, they must submit the certificate of completion to the court within 45 days of the first 341 meeting. Failing to show that they have completed this course could risk a dismissal of the bankruptcy case.

Repayment Plan Confirmation

If no creditor objects to the repayment plan, the confirmation hearing proceeds, and the plan is confirmed within 30 days of the first 341 meeting. If a creditor does object to the plan, this makes the case much more complicated. Speak with your attorney if one of your creditors objects to the proposed repayment plan.

Repayment Plan Duration

Usually, a Chapter 13 repayment plan will last anywhere from 36 to 60 months. The duration of the plan usually depends on several factors, including the debtor’s income and how much time they will need to complete the plan. For the duration of the plan, the debtor must make every monthly payment on time and submit the payments to the bankruptcy trustee.

If you fear that you cannot make one of your monthly payments, communicate with both your attorney and the bankruptcy trustee. From there, they will work with you to devise a solution, potentially by modifying the repayment plan.

Repayment plans can be modified after confirmation under certain circumstances. For example, if the debtor loses their job, gets into a car accident, suffers a serious illness, or encounters another roadblock, this can justify a modification.

If an issue arises that affects your ability to make payments, have your attorney work with the bankruptcy trustee to propose a modification of the plan to the bankruptcy court. All modifications are subject to approval by the court before they go into effect. You may also be able to convert Chapter 13 to Chapter 7 under certain circumstances.

Complete All Plan Payments

Once you make all your payments for your repayment plan, the plan is completed. The bankruptcy trustee will issue a Notice of Completed Plan Payments to the court. Then, you will meet with the court to confirm certain information before you can receive your discharge.

Chapter 13 Closing Process

The final stretch of your bankruptcy case will be handled largely by the bankruptcy trustee, as they must submit certain documents to the court. Usually, the closing process begins after you have completed all of your plan payments, which is around 36-61 months after filing.

Final Report from Bankruptcy Trustee

The trustee must then submit their final report to the court, generally within 4 months of the completion of the repayment plan. This report will inform the court of how the payments were disbursed to your creditors. Concerned parties have 33 days to object to the final report. If nobody objects, the final report is approved by the court.

Notice of Intent to Enter Discharge

After the final report is approved by the court and the debtor has certified certain information, the court will issue a Notice of Intent to Enter Discharge to all concerned parties. This notice informs the parties that the court is preparing to grant your bankruptcy discharge. Concerned parties have 14 days to object to the discharge.

Chapter 13 Bankruptcy Discharge

If no parties object, your Chapter 13 discharge will be granted. A bankruptcy discharge is a decree by the court that prevents creditors from attempting to collect on discharged debts. Think of discharged debts as forgiven debts that you are no longer responsible for paying. Most forms of unsecured debt are dischargeable through bankruptcy.

However, certain debts are not eligible for discharge through bankruptcy, not even through a hardship discharge. Nondischargeable debts include the following.

- Domestic support obligations such as alimony and child support

- Criminal fines and restitution payments

- Certain student loans

- Certain tax debts

Final Decree of the Bankruptcy Case

Around 14 days after you receive your discharge, the court will enter the final decree of the case. This decree officially closes the bankruptcy case and discharges the trustee from their responsibilities in the case.

How Do I Know When My Chapter 13 Is Over?

Your Chapter 13 bankruptcy case is officially, completely over once the court issues the final decree. You will be nearing the end of your case when you complete your repayment plan, submit your final paperwork, and receive your discharge order. Once these are completed, all that remains is receiving the final decree from the court.

Contact a Chapter 13 Lawyer in Kentucky with O’Bryan Law Offices

If your unsecured and secured debts are piling up, bankruptcy can give you the breathing room you need to repay them at a comfortable pace. With the protection of the automatic stay that bankruptcy provides, your creditors can no longer attempt collection efforts against you. This means you can save your house, save your car, stop wage garnishment, and much more. To learn more about how bankruptcy can benefit your situation, please contact the O’Bryan Law Offices today. Call our office at 502-339-0222 today to schedule a free consultation.