Chapter 7 Bankruptcy Timeline

Home » Louisville Bankruptcy Attorney » Chapter 7 Bankruptcy Timeline

Chapter 7 Bankruptcy: What To Expect

Filing bankruptcy is something that most people wish they never have to do. While it’s true that bankruptcy will hurt your credit score and make it more difficult to get credit in the future, it is actually an extremely helpful debt relief tool. The purpose of the bankruptcy procedure is to give debtors a way out of their difficult financial situation. Before someone files, it is crucial to understand the Chapter 7 bankruptcy timeline. This can help the process proceed as smoothly as possible.

If you are struggling with insurmountable debt, the Chapter 7 bankruptcy lawyers at O’Bryan Law Offices are here for you. We will ensure that every step of the Chapter 7 bankruptcy process goes smoothly for you. This includes taking your credit counseling course, taking the means test, filing your bankruptcy petition with the bankruptcy court, submitting the filing fee, gathering the proper documentation, and much more.

To schedule a free consultation with a member of our team, please call our bankruptcy law firm at 502-339-0222 today.

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is one of the two most common bankruptcy chapters, with the other being Chapter 13. It is also called liquidation bankruptcy because it involves the sale of a debtor’s nonexempt assets and the distribution of the proceeds to their creditors. In a Chapter 7 bankruptcy filing, you will not automatically lose all of your assets. You can exempt certain assets up to a certain amount according to the exemptions you use.

What Is the Chapter 7 Bankruptcy Discharge Timeline?

Here’s what you can expect leading up to and following bankruptcy:

You are eligible for a Chapter 7 discharge after 8 years have passed from the date you filed a prior Chapter 7 case and received a discharge.

You are eligible for a Chapter 7 discharge after 6 years have passed if you filed a Chapter 13 case and received a discharge.

If you have tried to delay or defraud your creditors by transferring, hiding, or destroying your property within a five-year period prior to your bankruptcy, the court may deny you a Chapter 7 discharge and even allow your creditors to recover the property that you transferred.

You are eligible for a Chapter 13 discharge after 4 years have passed from the date you filed a prior Chapter 7 case and received a discharge.

You are eligible for a Chapter 13 discharge after 2 years have passed from the date you filed a Chapter 13 case and received a discharge.

If you pay back one of your creditors who is also a relative or close business associate (“insider”) at any time within the 1-year period prior to the filing of your bankruptcy case, any amount over $600 may be recovered by the Chapter 7 trustee and the amount may then be distributed to your other creditors.

If you had a prior bankruptcy case dismissed within one year of the time you file a Chapter 7 case, the Automatic Stay entered in the Chapter 7 case will be terminated within 30 days unless you can demonstrate that the Chapter 7 case was filed in good faith.

If within 180 days, you had a prior bankruptcy case dismissed, then you may not file your bankruptcy case until this 180 day period expires.

Also, within 180 days, you must receive an individual or group briefing from an approved non-profit budget and credit-counseling agency.

You must be a state resident for at least 90 days before the filing. If not, you must file in the state where you have resided, or where your principal assets have been for the majority of the prior 180 days.

If you pay back a creditor over $600 within the 90-day period, the court may consider your payment a “preference” and may recover the amount over $600, distributing it to your other creditors.

New incurred debts of $500 or more for “luxury goods or services” or cash advances within the 90-day period, the debt is presumed to be nondischargeable.

You meet with our law firm for the initial consultation, retain our office and receive the bankruptcy packet of information for your completion. You complete your first step of credit counseling.

You return to our office for your Be-Back appointment where you meet with your paralegal to drop off your completed questionnaire, documents and attorney fee balance.

You return a third time to our office to meet with your attorney and paralegal to review and sign your petition and ask any follow up questions.

If you obtain a cash advance in the amount of $750 or more within a 70-day period before your bankruptcy, the debt is presumed to be nondischargeable.

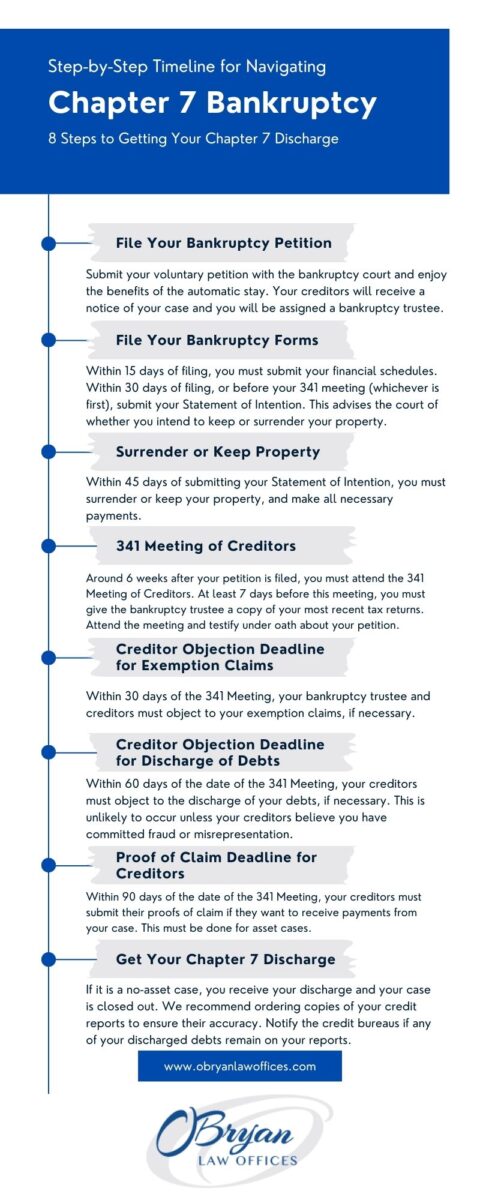

Your case is formally commenced when we file your bankruptcy petition with the appropriate bankruptcy court. As soon as we file your petition, the court will enter an Automatic Stay order prohibiting your creditors from taking or continuing any collection or legal action against you. Next, the court will send a notice of your case to all of the creditors listed in your petition. Additionally, the bankruptcy court will assign a bankruptcy trustee to oversee your case. The trustee will review your petition, make sure that it is complete, and then schedule a meeting of your creditors.

Within approximately 15 days after you file your case, the court will mail the Notice of Commencement of Case to you and to all of the creditors listed in your petition. This notice will inform you of the date set by the court for the meeting of your creditors, and the deadlines for your creditors to object to your case and file their claims against you.

You have a deadline of 15 days after you file your petition to file certain financial “schedules” with the court. These are documents declaring your assets, liabilities, expenses, income and a statement of your affairs. In most cases, however, we will file these forms for you with your petition.

Within 30 days after you file your case, or before the meeting of your creditors if that occurs first, you are required to file a Statement of Intention. In this document, you advise the court whether you intend to keep your property that serves as collateral for your debts, or whether you intend to surrender it to your creditors. Again, our firm will file this form for you.

If you intend to keep the property, you must indicate your intention to: (1) reaffirm your debts and continue making all of your payments on those debts; or (2) redeem the property by paying the fair market value for it, in which case you will receive a discharge of debt owed over the fair market value of the item.

You have 45 days after your Statement of Intention is filed to surrender or keep your property as you indicated in your Statement and make all necessary payments.

The court will hold the Meeting of Your Creditors about six weeks after your bankruptcy case is filed. At least seven days before this meeting, you are required to provide to the trustee and any creditor requesting it, a copy of your most recently filed tax return. We will do this for you!

The court-appointed trustee will preside over this meeting. At the meeting, which you are required to attend, you will be asked to testify under oath as to the accuracy of the statements in your petition. However, most of your creditors will not appear at the meeting, and you will not be before a judge. The meeting is very informal, and in most cases will last no more than 10 minutes. If you do not attend the meeting, your case will be dismissed.

Within 45 days after you file your petition, you must file a statement containing a certificate from your attorney that you received an explanation of the various chapters available to you under the bankruptcy code, evidence of any payments you’ve received from any employer within 60 days of your filing, an itemized statement of your monthly income, and an estimate of any increase in income or expenditures you expect over the next 12 months.

The bankruptcy trustee and your creditors have to object to all of your exemption claims within 30 days after the conclusion of the meeting of your creditors.

Your creditors have 60 days after the date first set for the Meeting of Your Creditors to object to the discharge of any of the debts listed in your petition and schedules.

Your creditors can object to your request to discharge a debt if the debt was obtained or incurred as a result of any of the following types of misconduct: fraud; embezzlement or larceny; and any willful or malicious injuries you have caused others; or a divorce or separation (this does not include debts for child support and spousal maintenance, which are nondischargeable by law).

Additionally, your creditors can object to the discharge of all your debts if you have engaged in any of the following conduct: concealment or destruction of property or financial records; false statements; withholding information; failing to explain losses; failure to respond to material questions; or a discharge in a prior case.

The trustee must move to dismiss your case within this time period if he finds that the granting of relief would be an abuse of the provisions of Chapter 7. You will receive your Chapter 7 discharge 60 days after the meeting of your creditors You will receive your discharge as soon as the 60-day time period for objecting to discharge or moving to dismiss your case expires. Even if you receive your discharge, the trustee may, however, move to set it aside if you do not turn over nonexempt property or if you commit other bankruptcy violations.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 imposes one last hurdle before you’re eligible for your discharge–the financial education requirement. This requires you to complete an instructional course concerning personal financial management. Your attorney can refer you to an approved financial management class.

If you have an asset case which you most likely will not have, all of your creditors (except for government entities) must file their proofs of claim (these are documents your creditors submit to the court specifying how much you owe them) within 90 days after the first date set for your creditor meeting if they wish to share in the payments from your case if any assets are available for liquidation.

If your case was a no asset case and there were no objections filed by the trustee and/or your creditors, your case will be discharged and closed out.

Finally, you should order copies of your credit reports from all three credit-reporting agencies to make sure that all of the debts you intended to discharge are zeroed out on your credit report with a notation that the debt was included in your bankruptcy. Pay the extra fee to receive your credit score.

Call us if your credit report is not accurate and we can help you dispute any inaccuracies in order to immediately improve your credit score.

Frequently Asked Questions About the Chapter 7 Timeline

How Long Does Bankruptcy Chapter 7 Last?

From submitting your bankruptcy petition to receiving your discharge order, Chapter 7 bankruptcy usually takes around 4-6 months to complete. It is a much shorter process than Chapter 13. The bankruptcy court process may even be as short as 90 days. If you have a no asset case, the bankruptcy judge may grant your Chapter 7 discharge as soon as a few weeks after filing. This means filers can achieve swift debt relief.

Can I File Chapter 7 Before 8 Years Have Passed?

According to bankruptcy law, you must wait 8 years from the filing date of your previous Chapter 7 petition. If you attempt to file bankruptcy before those 8 years have passed, you will not receive a bankruptcy discharge. If you are unsure of whether or not you qualify to file bankruptcy, speak with an experienced bankruptcy lawyer about your case. They can advise you of your Chapter 7 bankruptcy eligibility.

How Long Does a Chapter 7 Stay on Your Credit?

As many people know, one of the most significant bankruptcy consequences is the effect it has on your credit. After filing bankruptcy, you are likely to see your score drop at least 100 points, especially if you file with a relatively high score. Chapter 7 filings can remain on your credit report for up to 10 years from the date you file. However, it is possible to rebuild credit after bankruptcy. We recommend speaking with an experienced bankruptcy attorney for more information on how a Chapter 7 case might impact you.

Contact The Experienced Kentucky Bankruptcy Attorneys at O’Bryan Law Offices

If you are struggling with overwhelming debt, our team can help you prepare your bankruptcy forms, file your petition, and complete the bankruptcy process to receive your discharge order. We will be there with you every step of the way. Schedule a free consultation with a Louisville bankruptcy attorney at our firm. We have offices in Louisville, Frankfort, and New Albany. Contact us by calling 502-339-0222 or by emailing us through our website.

We are a law firm of experienced bankruptcy attorneys who help people file for bankruptcy relief under the United States Bankruptcy Code. Our team will guide you through the bankruptcy process from start to finish, ensuring that everything goes smoothly and providing you with the support you need.

We help to both educate and represent our clients during their bankruptcy filing. Some important aspects of these cases that we will advise you on include your credit counseling course, debtor education course, dischargeable and nondischargeable debts, repayment plan, and your final discharge. Don’t hesitate to contact a bankruptcy lawyer at our firm if you are struggling with personal loans, credit card debt, medical bills, or other forms of debt. Schedule your free initial consultation today.