750 Credit Score to 774 Credit Score

If you have a 750 credit score, or a similar score, you may wonder whether that score will significantly affect your finances. Because 750 to 774 scores are so high, they will show potential lenders that you are a safe borrower who is likely to repay their debts. With better loan terms and interest rates on offer, getting new credit with a score between 750 and 774 should be fairly easy.

At O’Bryan Law Offices, we understand that navigating the world of credit and finances can feel confusing. We also understand that filing for bankruptcy might seem like a bad choice that will only drop your credit score. However, bankruptcy is much more than that. It is a tool that debtors can use to achieve a fresh financial start, either through liquidation or a payment plan.

If you’re worried about what bankruptcy will do to your score, don’t be. Although you will see an initial drop, practicing good credit habits will help you raise your score higher than it was before in no time. To schedule a free consultation with us about your case, please call our office at 502-339-0222 today.

What Is Your Credit Score?

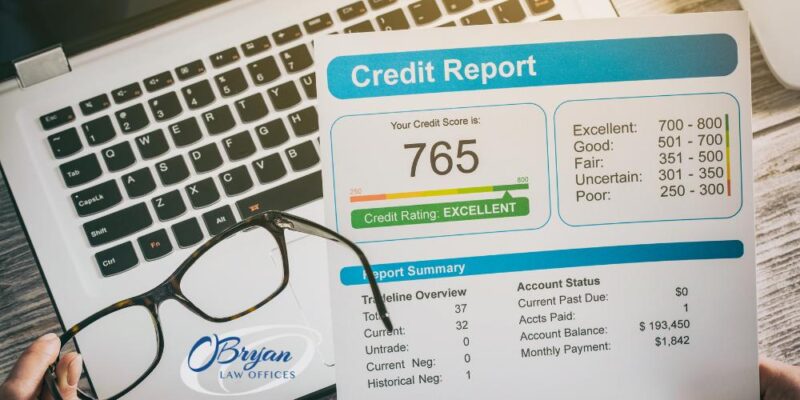

Your credit score is a numerical representation of your creditworthiness, indicating how likely you are to repay borrowed money. Ranging from 300 to 850, a higher score generally reflects better credit health. If your score falls between 750 and 774, you’re considered to have an excellent credit rating and a higher-than-average credit score. However, life’s uncertainties can lead anyone into financial challenges, and understanding how this range impacts your financial future is crucial.

Your credit score affects many aspects of your life, including your credit card balances, interest rates, mortgage rates, and more. The higher your score, the more likely a creditor is to extend credit to you with favorable terms. It might seem silly to place such significance on three numbers, but these numbers are anything but arbitrary. In the following sections, we discuss the various credit scoring models and how they calculate your credit scores.

What Are the Credit Scoring Models?

Various credit scoring models exist, with FICO and VantageScore being the most widely used. FICO, the older and more established of the two, is commonly used by lenders. VantageScore, a newer entrant, uses a similar scoring range but may weigh certain factors differently. Each has its own credit score range that it uses to calculate scores for credit reports. They both take into account factors like credit history, but they differ in the weight that they assign to different credit factors.

How Do Credit Bureaus Calculate Credit Scores?

Credit bureaus, such as Equifax, Experian, and TransUnion, calculate credit scores based on several factors. These factors include the following.

- Payment History (35%): Your track record of making payments on time.

- Credit Utilization (30%): The ratio of your credit card balances to your credit limits.

- Length of Credit History (15%): The average age of your credit accounts. A longer credit history tends to be more beneficial.

- Credit Mix (10%): The variety of credit accounts you have.

- New Credit (10%): The number of recently opened credit accounts and recent inquiries.

Understanding these components can help you make informed decisions to maintain or improve your credit score.

Why Do People Have Multiple Credit Scores?

It’s common to have multiple credit scores because lenders use different credit reporting agencies and scoring models. Each bureau may have slightly different information, leading to variations in each credit report. Monitoring all three major credit reports can provide a comprehensive view of your credit health.

What Are the Credit Score Ranges?

Below, we outline the credit score ranges for both FICO and VantageScore.

Rating | FICO Score Range | VantageScore Range |

Poor / Subprime | 580 and below | 300-600 |

Fair / Near Prime | 580-669 | 601-660 |

Good / Prime | 670-739 | 661-780 |

Very Good / Superprime | 740-799 | 781-850 |

Excellent | 800 and up | n/a |

FICO uses the terms “poor, fair, good, very good, and excellent” to describe one’s place in their credit score range. VantageScore, however, uses the terms “subprime, near prime, prime, and superprime” for their ranges. A credit score between 750 and 774 places you comfortably in the “Very Good” category, which generally qualifies you for favorable interest rates and loan terms.

Is 750 a Good Credit Score?

Absolutely. A 750 credit score is considered very good or prime. With this score, you’re likely to qualify for competitive interest rates on loans and credit cards. Lenders view you as a low-risk borrower, which can lead to better financial opportunities.

Is 755 a Good Credit Score?

Yes, a credit score of 755 is also very good or prime. Like a score of 750, it demonstrates responsible financial behavior and makes you an attractive candidate for loans and credit cards with favorable terms and higher credit limits.

Is 757 a Good Credit Score?

Certainly. A credit score of 757 falls within the “Very Good” range. This score indicates a strong credit history, positioning you well for loan approvals, lower interest rates, and a higher credit limit.

Is 759 a Good Credit Score?

Yes, a credit score of 759 is very good or prime. With this score, you’re likely to enjoy the benefits of lower interest rates and increased approval odds for credit applications. A 759 credit score indicates to lenders that you have good financial health.

Is 760 a Good Credit Score?

Absolutely. A credit score of 760 places you at the higher end of the “Very Good” range, indicating a stellar credit history and making you a highly attractive borrower. Credit card issuers and other creditors are more likely to give you favorable terms and low interest rates.

Is 762 a Good Credit Score?

Yes, a credit score of 762 is very good or prime. With such a high score, you can expect favorable loan terms and quick approvals when applying for credit.

Is 763 a Good Credit Score?

Certainly. A credit score of 763 is well within the “Very Good” range, showcasing your financial responsibility and making you a preferred borrower for new credit opportunities.

Is 765 a Good Credit Score?

Yes, a credit score of 765 is very good. With this score, you’re likely to receive the best interest rates and terms available, reflecting your strong credit management. Auto loans and other forms of credit are highly accessible with a 765 credit score.

Is 770 a Good Credit Score?

Absolutely. A credit score of 770 places you comfortably in the “Very Good” range, opening doors to the most favorable financial opportunities in an auto loan, mortgage, and more.

Does Bankruptcy Help Your Credit Score?

Bankruptcy is a complex and significant financial decision that can impact your credit score. While it initially results in a decrease in your score, it may offer long-term benefits by eliminating or restructuring your debts. Many people who initially see drastic drops in their scores can eventually see excellent credit scores after a few years of credit repair.

What Are the Short-Term Positives of Bankruptcy?

Debt Discharge: Bankruptcy can discharge or restructure unmanageable debts, providing immediate relief. One example of dischargeable debt is credit card debt.

Automatic Stay: Filing for bankruptcy initiates an automatic stay, halting creditor actions like foreclosure and wage garnishment.

Fresh Start: Bankruptcy offers a chance for a fresh financial start, allowing you to rebuild without the burden of overwhelming debt.

What Are the Long-Term Positives of Bankruptcy?

Rebuilding Credit: Despite the initial dip in your credit score, responsible financial behavior post-bankruptcy can lead to gradual improvement.

Debt-Free Future: Bankruptcy can pave the way to a debt-free future, giving you the opportunity to make sound financial decisions.

Improved Debt-to-Income Ratio: By eliminating or reducing debts through bankruptcy, your debt-to-income ratio improves, making you a more attractive borrower.

Contact a Kentucky Bankruptcy Attorney with O’Bryan Law Offices Today

If you’re facing financial challenges and considering bankruptcy, it’s crucial to have a knowledgeable and experienced attorney by your side. O’Bryan Law Offices is here to guide you through the complexities of bankruptcy, helping you make informed decisions about your financial future.

Our team of dedicated Kentucky bankruptcy attorneys understands the unique challenges you may be facing with a credit score between 750 and 774. We offer personalized and compassionate legal support, helping you navigate the legal process and work towards a brighter financial future.

Contact O’Bryan Law Offices today to schedule a consultation. We are committed to providing you with the guidance and representation you need to overcome financial challenges and move towards a more secure financial future. To schedule your free consultation, please call our office at 502-339-0222 today.