Bankruptcy Lawyers in Paducah, KY

Experienced Bankruptcy Attorney Serving Paducah and McCracken County

Are you struggling with overwhelming debt in Paducah, KY? Has financial stress become a daily problem in your life? You’re not alone, and there is a solution.

O’Bryan Law Offices brings over 30 years of experience to help Paducah residents overcome debt challenges. Our bankruptcy lawyer understands the unique economic pressures facing Western Kentucky families and can help you get back on solid financial ground.

We provide compassionate, knowledgeable guidance through every step of the bankruptcy process. Contact us today to start your journey toward a fresh start.

📞 Call (502) 339-0222 now for a free consultation with a trusted Paducah bankruptcy attorney.

Understanding Bankruptcy Options in Paducah, Kentucky

Bankruptcy offers a legal pathway to debt relief for individuals and businesses overwhelmed by financial obligations. With our firm’s guidance, you can find the right bankruptcy solution for your unique situation.

Many Paducah residents have successfully used bankruptcy to reset their financial lives. The bankruptcy process is designed to give honest individuals a chance to start fresh.

Bankruptcy cases for Paducah residents are processed through the United States Bankruptcy Court for the Western District of Kentucky, which handles all bankruptcy filings in our region.

⚖️ Paducah residents are particularly affected due to regional healthcare costs. Job loss, divorce, and unexpected emergencies also contribute to the number of bankruptcy filings in McCracken County.

What Bankruptcy Can and Cannot Do

What it can do:

- Stop creditor harassment and collection calls

- End wage garnishments

- Prevent foreclosure on your Paducah home

- Eliminate most unsecured debts like credit card balances

- Provide a structured repayment plan for manageable debt resolution

What it can’t do:

- Eliminate certain types of debt such as recent taxes or child support

- Remove all liens from your property

- Discharge most student loans

- Erase obligations from fraud or certain court judgments

Why Choose Our Paducah Bankruptcy Attorney

- Over 30 years of experience in Kentucky bankruptcy law

- Board-certified expertise in consumer bankruptcy

- Personalized attention to every client

- Transparent fee structure with no hidden costs

✨ When you work with O’Bryan Law Offices, you benefit from our decades of legal experience and our commitment to treating each client with respect and dignity. We understand that seeking bankruptcy help is a difficult decision, and we’re here to make the process as smooth as possible.

Attorney Julie O’Bryan brings extensive knowledge of bankruptcy law and court procedures to your case, ensuring you receive the best possible outcome based on your financial circumstances.

Types of Bankruptcy: Chapter 7 vs. Chapter 13

| Feature | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) |

|---|---|---|

| Timeline | 3–4 months | 3–5 year repayment plan |

| Income Requirements | Must pass means test | Requires regular income |

| Debt Resolution | Most unsecured debt eliminated | Partial repayment with remaining discharge |

| Property Protection | Non-exempt assets may be liquidated | Retain all property while paying |

| Credit Report Impact | 10 years | 7 years |

Chapter 7 bankruptcy offers a quick discharge of most unsecured debts, typically completing within 3–4 months. This form of bankruptcy is ideal for Paducah residents with limited income and few assets beyond basic necessities. Experienced chapter 7 bankruptcy lawyers can help ensure that you meet the eligibility criteria and maximize exemptions under Kentucky law.

Chapter 13 bankruptcy creates a 3–5 year court-approved repayment plan. This option works well for Paducah homeowners who want to save their property from foreclosure while catching up on mortgage payments. Chapter 13 bankruptcy also helps those whose income exceeds the threshold for Chapter 7.

🏠 Paducah’s diverse housing market—from historic homes in the Lower Town Arts District to newer developments in western McCracken County—means each bankruptcy filing requires individual attention to properly protect your home equity. While less common, municipal entities in Kentucky may also require specialized legal guidance from a chapter 9 bankruptcy lawyer when restructuring public debts.

Debts Dischargeable Through Bankruptcy

Bankruptcy effectively eliminates most unsecured debts, including:

- Credit card balances that have grown due to high interest rates

- Medical bills from Paducah hospitals and providers

- Personal loans

- Utility bills

- Certain older tax debts

However, bankruptcy cannot eliminate:

- Child support or alimony

- Recent tax liabilities

- Most student loans

- Court-ordered restitution

- Debts from fraudulent actions

💼 Paducah’s economic ties to the inland waterway system, healthcare sector, and regional commerce create unique financial pressures for local residents. Unexpected illness, business downturns, or employment changes can quickly lead to unmanageable debt for many in our community.

The Bankruptcy Process in Paducah

Filing for bankruptcy in Paducah begins with a thorough assessment of your financial situation. Our attorney will help you gather all necessary documentation, complete required forms, and file your case with the Western District bankruptcy court.

Before filing, you’ll complete mandatory credit counseling. After submission, you’ll attend a 341 meeting with the bankruptcy trustee, where they may ask questions about your financial situation.

For Chapter 7 cases, discharge typically occurs 60-90 days after this meeting. Chapter 13 requires adherence to your payment plan for 3-5 years before receiving a discharge.

Our experienced team will guide you through every step, ensuring all paperwork is properly completed and filed on time.

Costs of Filing Bankruptcy in Paducah

We believe in transparency about fees. Here’s what you can expect when filing bankruptcy in Paducah:

| Expense | Chapter 7 | Chapter 13 |

|---|---|---|

| Court Filing Fee | $338 | $313 |

| Credit Counseling | ~$15 | ~$15 |

| Credit Reports | $30-$50 | $30-$50 |

We understand that finding money for legal help can be challenging when you’re already facing financial difficulties. Our firm offers flexible payment arrangements for Paducah clients to make legal representation accessible when you need it most.

Stopping Creditor Harassment

One immediate benefit of filing bankruptcy is the automatic stay, which legally requires creditors to stop all collection attempts, including:

- Harassing phone calls at home and work

- Threatening letters

- Wage garnishments

- Foreclosure proceedings

- Repossession efforts

This protection begins the moment your bankruptcy petition is filed and provides immediate relief from the stress of constant collection attempts.

⚡ The automatic stay remains in effect throughout your bankruptcy case, giving you breathing room to address your debts through proper legal channels rather than under pressure from creditors.

Hypothetical Scenario: Ending Collection Harassment

🔍 Hypothetical Scenario: A Paducah healthcare worker fell behind on credit card payments after reduced hours during a hospital reorganization. Collection agencies began calling day and night, even contacting their workplace.

Within 48 hours of seeking help from an attorney, they filed their Chapter 7 bankruptcy petition, immediately stopping all collection calls. The relief was immediate—no more harassing calls, and within four months, their unsecured debts were discharged completely.

Life After Bankruptcy in Paducah

Many clients worry that filing for bankruptcy will permanently damage their financial future. The reality is that bankruptcy often marks a turning point toward better financial health.

While bankruptcy will remain on your credit report for 7-10 years, most Paducah clients see their credit scores begin to improve within 12-24 months as they build new credit history without the burden of overwhelming debt.

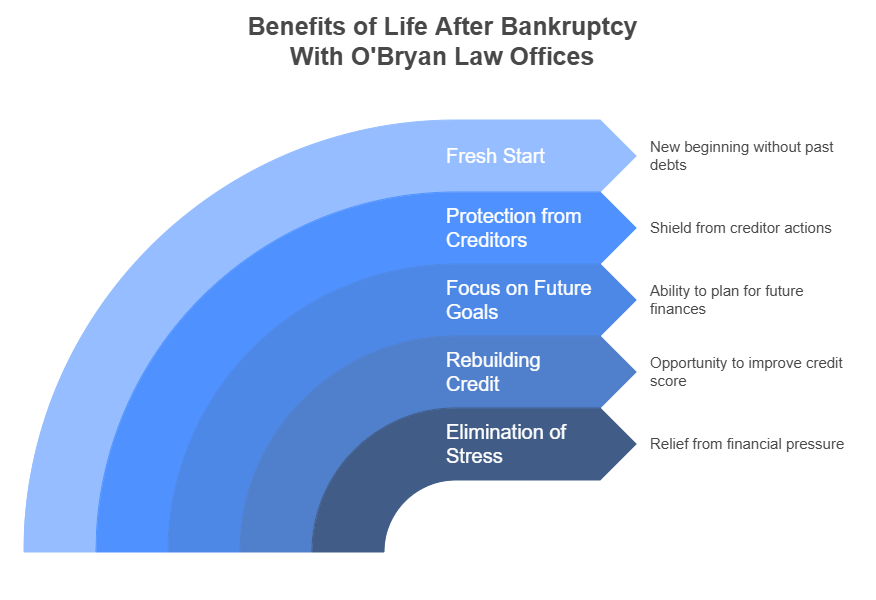

Our clients typically experience:

- Elimination of stress from unmanageable debt

- Ability to rebuild credit with careful planning

- Freedom to focus on future financial goals

- Protection from creditor actions

- A genuine fresh start

We don’t just help you file bankruptcy—we provide guidance on rebuilding your financial life after discharge. Many clients qualify for new credit cards within 6-12 months and auto loans within 2 years of discharge.

Alternatives to Bankruptcy

Before deciding if bankruptcy is right for you, we’ll discuss other potential solutions:

Combines multiple debts into a single loan with potentially lower interest. This works best for those with good credit and manageable debt levels.

Negotiating with creditors to reduce balances. This typically requires lump-sum payments and may create tax liabilities for forgiven debt.

Credit counseling agencies offer programs that structure repayment at reduced interest rates over 3-5 years.

🔄 While these alternatives help some people, they often prove insufficient for substantial debt. Our attorneys provide honest assessments of whether bankruptcy represents your best path to financial recovery.

Reaching Beyond Paducah: Serving Western Kentucky

While our focus is helping Paducah residents, we also serve clients throughout McCracken County and the surrounding areas. Our knowledge of Western Kentucky’s economic landscape allows us to provide effective debt relief solutions tailored to local needs.

Our attorneys can help you address both personal and business bankruptcy matters, from simple Chapter 7 filings to more complex Chapter 13 reorganizations.

Contact Our Bankruptcy Lawyer in Paducah, KY Today

Taking the first step toward financial recovery can be challenging, but it’s the most important move you’ll make toward resolving your debt issues. O’Bryan Law Offices provides experienced guidance through every phase of the bankruptcy process.

Our attorney will evaluate your situation, explain all your options, and help you determine if bankruptcy is your best solution. During your free consultation, we’ll address your concerns and outline a clear path forward.

With offices serving all of Kentucky, our lawyers regularly assist clients throughout McCracken County. Call (502) 339-0222 to schedule your free consultation.

The sooner you reach out, the sooner we can help stop creditor harassment, protect your property, and guide you toward financial freedom. Don’t wait until things get worse—contact us today to learn how we can help you get the fresh start you deserve.

FAQs About Bankruptcy in Paducah, KY

In most cases, no. Kentucky’s homestead exemption protects up to $31,575 in home equity—sufficient for many Paducah properties. For higher equity levels, Chapter 13 allows you to keep your home while catching up on mortgage payments through a structured repayment plan.

Almost immediately. The automatic stay takes effect the moment your bankruptcy petition is filed, legally requiring all creditors to stop collection attempts. We can often file a case within 1-2 business days of receiving your complete information and retainer.

Bankruptcy eliminates most unsecured debts like credit cards and medical bills. However, certain obligations like child support, recent taxes, most student loans, and court fines cannot be discharged. We’ll review your specific debts to determine what can be eliminated.

Qualification depends on your income, assets, debt types, and financial history. For Chapter 7, you must pass a “means test” comparing your income to McCracken County’s median. For Chapter 13, you need regular income sufficient to make plan payments. During your consultation, we’ll evaluate your eligibility.

In most cases, yes. Kentucky exemptions allow you to protect up to $5,000 in vehicle equity. For vehicles with higher equity, Chapter 13 bankruptcy often provides a solution that lets you keep your transportation while addressing your debt.

Chapter 7 bankruptcy typically completes in 3-4 months from filing to discharge. Chapter 13 requires a 3-5 year repayment plan before receiving a discharge. The exact timeline depends on your specific circumstances and case complexity.