Restoring Credit

Home » Life After Bankruptcy » Restoring Credit

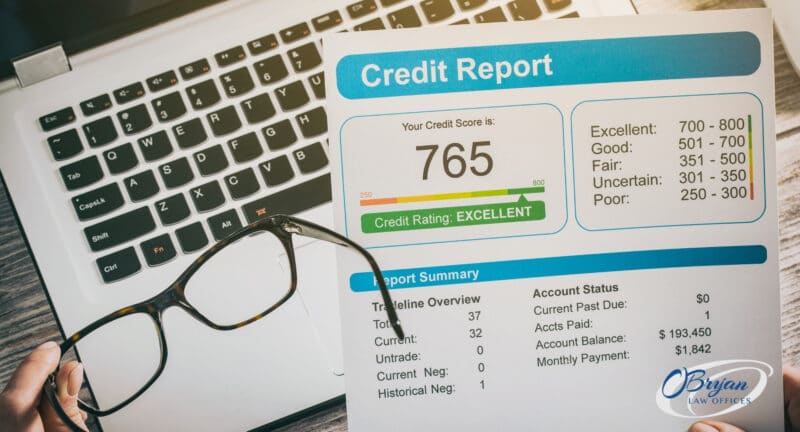

How to Build Credit After Bankruptcy

Helping our clients restore their credit scores is a priority at O’Bryan Law Offices. It’s so important that we offer the 7 Steps to a 720 Credit Score Program (valued at $1,000) for FREE to our clients. Many of our Chapter 7 and Chapter 13 clients qualify for market-rate home mortgages and car loans within two years of discharge so long as they have been responsible with their credit after filing bankruptcy. 7 Steps to a 720 Credit Score can show you how to build credit after bankruptcy.

Learn more about the 7 Steps to a 720 Credit Score. To gain access to this amazing credit restoration program, call O’Bryan Law Offices today at 502-339-0222 and schedule an appointment.

Will Bankruptcy Ruin My Credit Forever?

No, bankruptcy will not ruin your credit forever! This bankruptcy myth is one of the many reasons why debtors wait so long to file bankruptcy. It’s true that a bankruptcy filing can stay on your credit report for 7 to 10 years. But if you’re drowning in debt due to years of missed monthly payments, chances are that will stay on your credit history for the same amount of time or even longer.

The people who belong in bankruptcy are most often those who have an incredibly poor credit score. So you really have to pick your battle: poor credit score from bankruptcy or from too much debt and not making timely payments? When you file bankruptcy, you’re essentially freed from some or all of your unsecured credit card debt and various secured debts as well. Taking care of this debt can slowly rebuild your credit history.

Contact one of our experienced bankruptcy attorneys at O’Bryan Law Offices in Kentucky and Indiana to learn how to build credit after bankruptcy. In fact, many of our clients get credit card offers within a few weeks of their bankruptcy filing. We can show you how to build on these opportunities by concentrating on achieving a good credit score.

O’Bryan Law Offices Can Help You Recover and Manage Your Personal Finances

Access to good credit is essential to full participation in American society. As bankruptcy lawyers, we think it’s just as important to help you recover your credit as it is to get relief from your past debts. We now offer credit rebuilding programs for a minimal fee. Within a year or two after completing your bankruptcy process, you should qualify for a car loan at a more favorable market rate. Within two years, you should be able to buy a house at incredible interest rates.

Steps to Re-establish Your Credit After Bankruptcy

It’s definitely possible to rebuild good credit history after bankruptcy. It does take work, patience, and plenty of timely payments though. When you work with O’Bryan Law Offices to rebuild new credit, we’ll guide you through the following steps to get your financial life back on track.

Keep Up With Debts That Survived Bankruptcy

Depending on which chapter of bankruptcy you filed, you may have some debts that survived, like secured loans or student loans. If that’s the case, you need to focus on making on-time payments every month so that you don’t end up in the same financial situation as before. Additionally, it’s crucial to stay on top of rent payments, unsecured credit card payments, and other debt payments. Timely payments are possibly the most important credit builder out there.

Become an Authorized User on Someone Else’s Credit Card

Another great way to build better credit reports is to become an authorized user on someone else’s credit card. A friend or a family member may be a trustworthy option. Make sure that the person whose card you’re using has a good credit report and makes on-time payments. If not, this tip will certainly backfire on you and damage your credit report. Additionally, make sure the credit card issuer includes authorized users in their credit reports, or you won’t reap the benefits.

Get a Secured Credit Card

Secured credit cards are very similar to unsecured credit cards in that you have to pay credit card issuers and then borrow from them. A secured card still accumulates interest fees. But as long as you keep up with your payments, credit bureaus and credit reports will remain happy.

Get a Regular Credit Card

Having a regular, unsecured card is a great credit builder too. You will probably get several offers for unsecured cards in the mail before your bankruptcy case comes to a close. But be wary of these offers because many credit card companies charge high interest rates for those who have just endured a bankruptcy proceeding.

Obtain a Credit Builder Loan

Credit builder loans are different from traditional loans in that you don’t receive borrowed money upfront and then gradually pay it back. Instead, you make fixed, on-time payments so that you can access the loan at the end of its term. Lenders such as credit unions, community banks, and credit bureaus would put the credit builder loan into a savings account so that you can make timely payments. If done correctly, this method can greatly improve your credit report and payment history after bankruptcy.

Report Payment Information

Some credit reporting agencies allow people to use other payment information (like water bills, phone bills, rent payments, etc.) as a credit builder opportunity. Check with your agency and see if this is an option for you.

Monitor Your Credit Rating

Monitor your credit reports regularly with the three major credit bureaus: TransUnion, Experian, and Equifax. You are entitled to receive one free credit report each year from these major credit bureaus.

Develop Responsible Debt and Credit Habits

Lastly and possibly most importantly, the secret to financial security is being responsible with your debt and credit habits. You want to keep your credit card balances low and remember your credit utilization ratio. Try to pay more than the minimum on your cards every month. Also, keep your credit utilization ratio less than 30% of your credit limit because this will notify lenders that you can repay the money you borrow. If you’re unsure about how much available credit you’re using, make sure to check a couple of credit scoring models. Bankruptcy attorneys at O’Bryan Law Offices teach our clients this and so much more in our debt counseling course.

Bankruptcy as a Credit Restoration Tool

Because you only get one discharge in eight years for successive Chapter 7’s, it’s very important to make the most of the opportunity that bankruptcy can present for repairing your credit report. To learn how to build credit after bankruptcy, contact one of our lawyers at O’Bryan Law Offices in Louisville, Frankfort, or New Albany.