Frankfort Bankruptcy Lawyers

Are you struggling with overwhelming debt and feeling like there’s no way out? Creditor calls disrupting your peace of mind, wage garnishments threatening your livelihood, and the constant fear of losing your home or car keeping you awake at night?

You’re not alone in this financial crisis, and more importantly, you don’t have to face these financial difficulties alone.

When debt becomes unmanageable and traditional solutions fall short, bankruptcy can provide the fresh start you desperately need.

At O’Bryan Law Offices, our experienced Frankfort bankruptcy lawyer understands the stress and anxiety that comes with severe financial hardship. We’ve helped over 30,000 families across Kentucky and Indiana find their path to financial freedom through strategic bankruptcy planning.

Whether you’re managing the financial impact of an uncontested divorce or considering options like Chapter 13 bankruptcy to catch up on missed payments, understanding your rights under Kentucky bankruptcy law is critical. For some, Chapter 7 may offer faster relief, while others benefit more from a structured repayment plan.

Our Frankfort bankruptcy attorneys are here to help you make sense of your options with clarity and compassion. We provide honest legal guidance tailored to your circumstances and will only recommend bankruptcy if it’s the right fit for your long-term financial goals.

Take the first step toward financial freedom—schedule your free consultation with board-certified bankruptcy attorney Julie O’Bryan and her team today. Call us at (502) 339-0222 or contact us online to get started.

A Brief Overview of Bankruptcy in Frankfort, KY

Bankruptcy is not a sign of personal failure—it’s a powerful legal tool designed to provide relief for honest debtors facing insurmountable financial burdens. Filing for bankruptcy in Kentucky falls under federal jurisdiction, with cases handled by the U.S. Bankruptcy Court for the Eastern District of Kentucky, which has jurisdiction over Frankfort and surrounding areas.

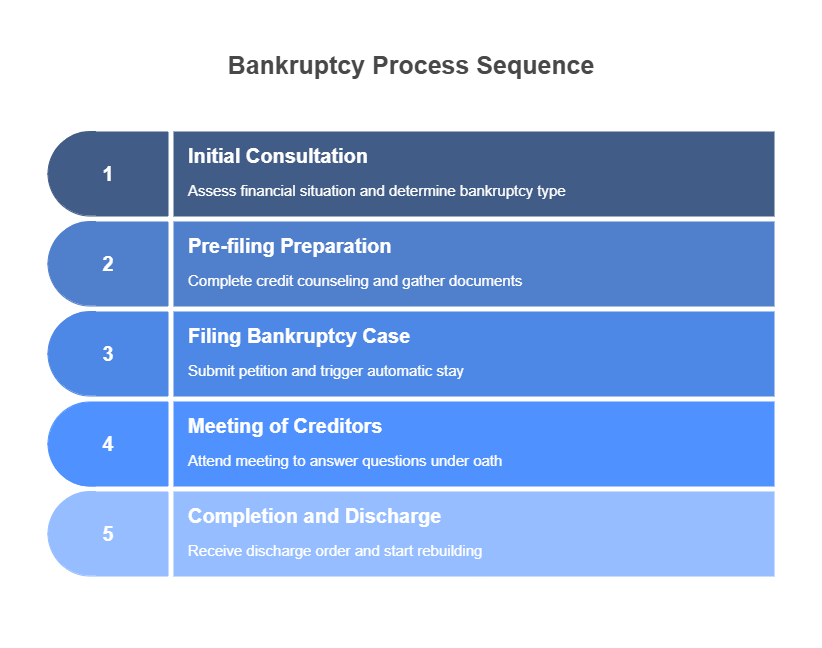

The bankruptcy process follows a structured timeline designed to protect both debtors and creditors while ensuring fair resolution:

- Initial consultation and case evaluation: We assess your financial situation, review your debts, and determine the most appropriate type of bankruptcy for your circumstances.

- Pre-filing preparation: Complete required credit counseling, gather financial documents, and prepare your bankruptcy petition with detailed asset and debt information.

- Filing your bankruptcy case: Submit your petition to the bankruptcy court, triggering automatic stay protection that immediately stops creditor harassment and collection actions.

- Meeting of creditors (341 meeting): Attend a brief meeting where you’ll answer questions about your finances under oath, with your attorney present for support.

- Completion and discharge: Receive your discharge order, eliminating eligible debts and providing you with a fresh start to rebuild your financial future.

📌 Understanding Kentucky bankruptcy laws is important, but you don’t have to figure it out alone. We’re here to guide you every step of the way and help you make the most of the protections available.

What Bankruptcy Can & Cannot Do For You

Bankruptcy offers powerful debt relief options, but it’s important to understand both its capabilities and limitations before making this significant decision.

| Bankruptcy CAN | Bankruptcy CANNOT |

|---|---|

| Stop foreclosure proceedings and repossession actions | Eliminate child support or alimony obligations |

| End wage garnishment immediately | Discharge most student loans (except in rare hardship cases) |

| Eliminate credit card debt and medical bills | Remove recent tax debts or court-ordered fines |

| Discharge certain older tax debts | Eliminate debts incurred through fraud |

| Provide immediate relief from creditor harassment | Remove co-signer liability in Chapter 7 cases |

| Protect exempt property under Kentucky law | Discharge secured debts without surrendering collateral |

Federal bankruptcy laws work in conjunction with Kentucky state exemptions to determine what property you can keep during the bankruptcy process. It’s essential to understand questions such as when is it too late to stop foreclosure and how timing affects your options.

📌 We’ll walk you through the pros and cons of filing for bankruptcy so you can decide if it’s the right solution for your financial future.

Why Choose O’Bryan Law Offices as Your Bankruptcy Attorneys in Frankfort, KY?

With nearly 30 years of experience serving families across Kentucky and Indiana, O’Bryan Law Offices has become the region’s premier consumer bankruptcy law firm, trusted by countless clients in Frankfort and beyond.

Our founding attorney, Julie O’Bryan, holds the distinguished honor of being board-certified in consumer bankruptcy law by The American Board of Certification—one of only six such certified attorneys in all of Kentucky.

This board certification represents the highest level of expertise and commitment to bankruptcy law, requiring extensive experience, continuing education, and demonstrated competency in handling complex bankruptcy cases.

Our unique advantages include:

- Over 30,000 families helped through successful bankruptcy filings and debt relief solutions

- Board-certified bankruptcy attorney on staff, ensuring the highest level of expertise

- Personalized attention with every client meeting directly with an attorney, not just support staff

- Convenient locations in Louisville, Frankfort, and New Albany to serve your needs

- Flat-fee billing with no surprise charges or hourly billing for quick questions

- Family-owned and family-focused approach, providing a comfortable environment with respectful guidance

We differ from other Kentucky law firms with our outstanding service, impeccable reputation, and full-service legal guidance we give our clients from start to finish.

SUPERIOR SERVICE

We maintain regular contact and communication with you while representing your personal bankruptcy, car wreck, or other related practice areas. As our client, you receive the very best from our outstanding lawyers.

Our Frankfort legal team works with you ensuring we devise the best action plan and make the best decisions for you and the legal issues you face. We ensure we answer all of your questions about the types of bankruptcy, bankruptcy do’s and don’ts, bankruptcy mistakes to avoid, and how often you can file bankruptcy.

Read Also: Can I File for Bankruptcy After Being Sued?

REPUTATION

In addition to sharing productive and beneficial relationships with our clients, we receive peer recognition for our outstanding reputation. Providing an array of services for the past 28 years, we guide clients through difficult circumstances, including:

- Debt counseling

- Divorce-related bankruptcy

- Student loans and bankruptcy

- Bankruptcy planning and asset protection

- Reaffirmation of debt

- Stop wage garnishment

- Stop creditor harassment

- Restoring credit

- Save your car from repossession

- Save your house from foreclosure

Bankruptcy and family law are overwhelming and complex processes. We handle the challenging tasks, so you don’t have to.

FULL-SERVICE LEGAL GUIDANCE

We ensure we fully understand your legal requirements before creating your personalized debt-relief solutions. We provide various bankruptcy options to each of our clients so you reach your bankruptcy goals in the best way for you.

Before your bankruptcy filing, we discuss how to achieve the highest credit score possible and offer advice about which documents you need to file a Chapter 13 or a Chapter 7 bankruptcy and how to become debt-free.

Not only do we help our clients become debt-free through bankruptcy, but we also help them achieve future financial success. You don’t want to fall back into a financial hole after filing bankruptcy. This is your opportunity for a fresh start and to set achievable financial goals.

Our law firm offers credit counseling, debt consolidation, and debt counseling for clients who want to exercise choices other than bankruptcy. Please visit our website or call our Frankfort offices for more information about your legal options or to schedule a free consultation.

Reliable Community-Focused Legal Services

Being an integral part of the Frankfort community is important to O’Bryan Law Firm, and helping our fellow residents is our aim. Helping our clients reach lasting financial freedom is near and dear to our hearts and one of the most significant parts of what we do.

Our community becomes better when our friends and neighbors gain financial stability and freedom from overwhelming debt. As residents of this community, we are very conscious of our work’s life-changing impact.

O’Bryan Law Offices is the legal representation you need when you’re looking for an attorney invested in the outcome of your bankruptcy case.

Let our experience work for you. O’Bryan Law Offices delivers trusted guidance, personal attention, and proven results. Call us at (502) 339-0222 or contact us online to schedule your free consultation today.

Types of Bankruptcy: Chapter 7 vs. Chapter 13

Understanding the differences between Chapter 7 and Chapter 13 bankruptcy is key to making the right choice for your situation. Each chapter serves different needs and offers distinct advantages:

| Feature | Chapter 7 Bankruptcy | Chapter 13 Bankruptcy |

|---|---|---|

| Duration | 3-4 months | 3-5 years |

| Income Requirement | Must pass means test | Must have regular income |

| Debt Relief | Most unsecured debts discharged | Partial repayment plan + discharge |

| Property Protection | May lose non-exempt assets | Keep all property while repaying |

| Co-Signer Protection | No protection for co-signers | Co-debtor stay protects co-signers |

| Foreclosure Relief | Temporary delay only | Can cure arrearages over time |

| Eligibility | Income below state median | Any income level with regular payments |

Chapter 7 bankruptcy, often called “liquidation bankruptcy,” is ideal for individuals with limited income who need to eliminate unsecured debts quickly. If you file a Chapter 7 bankruptcy, you can typically discharge credit card debt, medical bills, and other unsecured obligations within 90-120 days.

💡 Read Also: How to File Chapter 7 With No Money

Chapter 13 bankruptcy works better for individuals with regular income who want to keep their property while reorganizing their debts. When you file a Chapter 13, you create a repayment plan that allows you to catch up on mortgage or car payments while potentially reducing overall debt obligations.

Our Frankfort bankruptcy lawyers will analyze your specific financial situation to determine which type of bankruptcy offers the best path forward for achieving financial freedom.

Important Information From Our Bankruptcy Lawyers in Frankfort, KY

While this may seem like overwhelming information, our experienced team will walk you through exactly how these important areas apply to your specific bankruptcy case during your consultation. Understanding these key concepts helps you make informed decisions about your financial future.

Debts Dischargeable Through Bankruptcy

Most personal bankruptcy cases successfully eliminate the following types of debt:

Dischargeable Debts:

- Credit card balances and store cards

- Medical bills and hospital debt

- Personal loans and payday loans

- Certain older tax debts (typically over 3 years old)

- Utility bills and collection accounts

- Business debts from sole proprietorships

Non-Dischargeable Debts:

- Child support and alimony obligations

- Most student loans (limited exceptions apply)

- Recent tax debts and penalties

- Debts incurred through fraud or false statements

- Court-ordered fines and restitution

⚖️ Each debt type requires individual analysis, and our attorneys will review every obligation to determine discharge eligibility and develop strategies to address non-dischargeable debts.

Protecting Your Assets: Exempt & Non-Exempt Property

Kentucky bankruptcy exemptions allow you to protect essential property during the bankruptcy process. Understanding these exemption limits helps you plan effectively:

Kentucky Exemption Highlights:

- Homestead exemption: Up to $31,575 in home equity

- Vehicle exemption: Up to $5,000 in car value

- Personal property: Household goods, clothing, and tools of trade

- Retirement accounts: 401(k), IRA, and pension plans fully protected

- Wildcard exemption: Up to $1,850 for any property, depending on exemption rules applied

📌 Our attorneys use strategic pre-bankruptcy planning to help you maximize exemptions and protect as much property as possible while still achieving debt relief.

For vehicle-related concerns, understanding when do I have to surrender my vehicle in a Chapter 13 can help you make informed decisions about your transportation needs.

Impact on Credit + Life After Bankruptcy

Bankruptcy will remain on your credit report for 7-10 years, but many clients begin rebuilding their credit score within 12-24 months after discharge. The key is taking proactive steps to demonstrate financial responsibility:

Credit Rebuilding Timeline:

- Immediate: Obtain secured credit cards and make small purchases

- 6-12 months: Monitor credit reports and dispute any inaccuracies

- 12-24 months: Qualify for conventional car loans with a reasonable interest rate

- 24-36 months: Consider FHA mortgage loans for home purchases

Automatic Stay Protection

The automatic stay is one of bankruptcy’s most powerful features, providing immediate relief from creditor actions. This federal protection takes effect the moment you file your bankruptcy petition:

Automatic Stay Halts:

- Creditor calls and harassment: All collection calls must stop immediately, giving you peace of mind

- Wage garnishments: Payroll deductions cease, allowing you to keep your full paycheck

- Lawsuits and court proceedings: Pending litigation gets suspended while bankruptcy is pending

- Foreclosure actions: Mortgage companies cannot proceed with foreclosure sales during bankruptcy

- Repossession attempts: Vehicle lenders cannot repossess cars without court permission

✔️ Violating the automatic stay can result in significant penalties for creditors, and our attorneys aggressively protect your rights under this federal law.

Co-Signers and Bankruptcy Implications

Bankruptcy affects co-signers differently depending on which chapter you file:

Chapter 7 implications: Co-signers remain fully liable for joint debts even after your discharge, potentially straining family relationships and finances.

Chapter 13 advantages: The co-debtor stay protects co-signers from collection actions while you complete your repayment plan, preserving important relationships.

📌 Understanding does bankruptcy affect a spouse is vital for married couples considering their options. Our attorneys structure cases to minimize impact on family relationships while maximizing debt relief.

Employment Considerations

Federal law (Section 525 of the Bankruptcy Code) prohibits employment discrimination based on bankruptcy filing, protecting your current job and future employment opportunities.

Kentucky follows federal employment protections, and many clients find that eliminating debt-related stress improves their work performance and career prospects. The Kentucky Labor Cabinet provides additional resources for understanding your employment rights during financial restructuring.

💡 Many clients find that bankruptcy improves their employability by eliminating wage garnishments and reducing financial stress that affects job performance.

Timeline of the Bankruptcy Process

Understanding the typical timeline helps you plan for life during and after bankruptcy:

Chapter 7 timeline: Approximately 90-120 days from filing to discharge

- Filing for 341 meeting: 4-6 weeks

- 341 meeting to discharge: 60-90 days

- Total process: 3-4 months

Chapter 13 timeline: 3-5 years, depending on your repayment plan

- Confirmation hearing: 2-3 months after filing

- Monthly payments: 36-60 months

- Final discharge: After completing all payments

Our firm’s experience minimizes delays by ensuring complete, accurate filings and proactive communication with trustees and court personnel from start to finish.

Costs Associated With Filing for Bankruptcy in Frankfort

Bankruptcy costs vary based on case complexity, but transparency in pricing helps you plan effectively:

| Expense | Chapter 7 | Chapter 13 |

|---|---|---|

| Court Filing Fee | $338 | $313 |

| Attorney Fees (typical) | $1,500-$2,500 | $4,500-$4,750 |

| Credit Counseling Course | ~$15 | ~$15 |

| Debtor Education Course | ~$15 | ~$15 |

Filing costs are often less than two months of minimum credit card payments, making bankruptcy a smart long-term investment in your financial future.

💡 We offer flexible payment plans and competitive rates, ensuring that financial constraints don’t prevent you from accessing the debt relief you need.

Alternatives to Bankruptcy

Our commitment to honest legal services means we won’t recommend bankruptcy unless it’s truly your best option. Alternative debt relief solutions include:

- Debt consolidation: Combining multiple debts into a single payment, potentially with lower interest rates.

- Debt negotiation: Working directly with creditors to reduce balances or establish payment plans, though this approach has significant limitations and risks.

- Debt management plans: Structured repayment programs through credit counseling agencies, suitable for moderate debt levels with steady income.

Each alternative has pros and cons, and our attorneys provide honest assessments of which approach offers the best long-term solution. Understanding debt settlement pros and cons and why you should never pay a collection agency helps you make informed decisions about debt relief options.

Contact a Frankfort Bankruptcy Lawyer at O'Bryan Law Offices Today

Don’t let financial stress control your life any longer—take the first step toward financial freedom by contacting our experienced Frankfort bankruptcy attorneys today.

Our team understands the emotional and financial toll of insurmountable debt, and we’re here to provide the compassionate, professional legal services you need to rebuild your financial future. From start to finish, we’ll guide you through every aspect of your bankruptcy case, ensuring you understand your options and feel confident in your decisions.

As a family-owned law firm, we provide a comfortable environment and treat you with the one-on-one, respectful guidance you deserve. When you choose us, we assign an attorney and two paralegals to your case, all dedicated to providing the prompt, responsive guidance you need to help you achieve your fresh financial start.

Our reputation for excellence is backed by a “Superb” rating on Avvo, recognition by Super Lawyers, and a profile on Justia. Owner Julie O’Bryan is a long-standing member of the Kentucky Bar Association, committed to the highest standards of legal ethics and client care.

Call us today at 502-339-0222 or visit our contact page to schedule your free consultation and take the first step toward your fresh start.

FAQs

Will filing bankruptcy ruin my chances of getting a job?

No, federal law prohibits most employers from discriminating against you based on a bankruptcy filing. Many clients find their job prospects improve after bankruptcy because they’re no longer dealing with wage garnishments or constant financial stress that can affect work performance.

Can I keep my car if I'm still making payments?

Yes, in most cases, you can keep your vehicle by continuing to make payments through a reaffirmation agreement in Chapter 7 or by including the payments in your Chapter 13 plan. Our attorneys will help you understand your options based on your car’s value and remaining loan balance.

What happens if I can't afford to pay my attorney fees upfront?

We understand that financial hardship makes it difficult to pay large sums upfront. That’s why we offer flexible payment plans and allow you to get started with just a $300 payment toward your legal fees during your initial consultation.

Will my employer find out if I file for bankruptcy?

Generally, no. Bankruptcy filings are public records, but employers don’t routinely check these records. The main exception is if you have a wage garnishment that your employer is already processing—bankruptcy will stop this garnishment, which your payroll department will notice as a positive change.

Can I file bankruptcy if I've already tried debt consolidation or settlement?

Absolutely. Many clients come to us after unsuccessful attempts at debt consolidation or settlement programs that didn’t provide the relief they needed. Previous debt management attempts don’t disqualify you from bankruptcy relief, and often bankruptcy provides the comprehensive solution that other methods couldn’t deliver.