Yes, filing for bankruptcy can immediately stop most civil lawsuits through automatic stay protection. The moment you file your bankruptcy petition, federal law requires creditors to halt all collection activities, including ongoing litigation against you.

When creditors file lawsuits against you, the legal system works quickly against your interests. You face mounting legal fees, potential wage garnishment, and the constant stress of court proceedings. Many Kentucky residents discover that even if they want to fight the lawsuit, they lack the resources for effective legal representation.

The reality is harsh: Most people served with civil lawsuits feel trapped between expensive legal defense costs and the certainty of a judgment against them.

Without action, your situation deteriorates rapidly. Kentucky law allows creditors who win lawsuits to:

- Garnish up to 25% of your disposable wages from every paycheck

- Freeze your bank accounts without warning

- Place liens on your property that follow you for up to 15 years

- Renew judgments for an additional 10-year period

The financial damage compounds as legal fees pile up, collection actions intensify, and your credit score plummets. Meanwhile, the original debt continues growing with interest and penalties.

Filing for bankruptcy activates immediate federal protection that stops civil lawsuits in their tracks. This legal shield, called an automatic stay, gives you breathing room to address your debts comprehensively rather than fighting individual creditors one by one.

The strategic advantage: Instead of spending thousands defending a single lawsuit you might lose anyway, bankruptcy addresses all your debts simultaneously while protecting your assets and future earnings.

At O’Bryan Law Offices, our bankruptcy lawyers in Louisville have helped thousands of Kentucky families stop civil lawsuits and achieve lasting debt relief. Our board-certified bankruptcy attorney, Julie O’Bryan, understands exactly when and how to file for maximum protection of your rights and property.

Can You File Bankruptcy On a Lawsuit?

Yes, you are able to file bankruptcy after someone brings a lawsuit against you. Whether you were just served or a judgment has already been entered against you, filing for bankruptcy after a lawsuit is possible.

When a lawsuit is filed against you, it may be exceedingly difficult to stop it. You are essentially left with a few options. For one, you can fight the lawsuit, which means there is a 50/50 chance of winning. You can also choose to settle and pay off the debt. That is, of course, if you have the means to do so. In the case that you do not have the means, you have the option of filing a bankruptcy petition.

Your Strategic Window

The timing of your bankruptcy filing creates different advantages depending on the lawsuit’s stage. Kentucky’s civil procedures, governed by the Kentucky Court of Justice, give defendants specific windows of opportunity that bankruptcy can maximize.

⚖️ Early Filing Benefits: Filing bankruptcy within Kentucky’s 30-day lawsuit response period prevents the creditor from obtaining a default judgment and stops the case before expensive legal discovery begins.

Cost Comparison Analysis

When a lawsuit is filed against you, consider the financial reality of your options:

| Option | Upfront Cost | Potential Total Cost | Success Rate |

|---|---|---|---|

| Fight the lawsuit | $500-2,000+ in legal fees | $10,000+ if you lose | Variable (depends on debt validity) |

| Settle the debt | 30-60% of the balance | Settled amount only | 95% resolution rate |

| File bankruptcy | $300-1,500 total | Fixed fee only | 99% debt discharge rate |

Note: The above figures are not exact and will vary, depending on your situation. They are for informational purposes only.

The "Judgment Proof" Misconception

Many people believe they’re “judgment proof” because they have no assets. This is rarely true in Kentucky. Even if you own little now, a judgment can follow you for years and attach to future assets, wages, or property you acquire.

Kentucky-Specific Consideration: Kentucky allows garnishment of up to 25% of disposable earnings, and judgments can be renewed for up to 15 years, making them particularly problematic for your financial future.

Hypothetical Scenario: A Louisville resident received a $15,000 credit card lawsuit. Instead of filing an immediate bankruptcy response, they attempted to negotiate. Six months later, the creditor obtained a judgment and began garnishing $400 monthly from their wages. Filing bankruptcy at that point required additional steps to stop the garnishment and remove the judgment lien from their property.

When Fighting Makes Sense

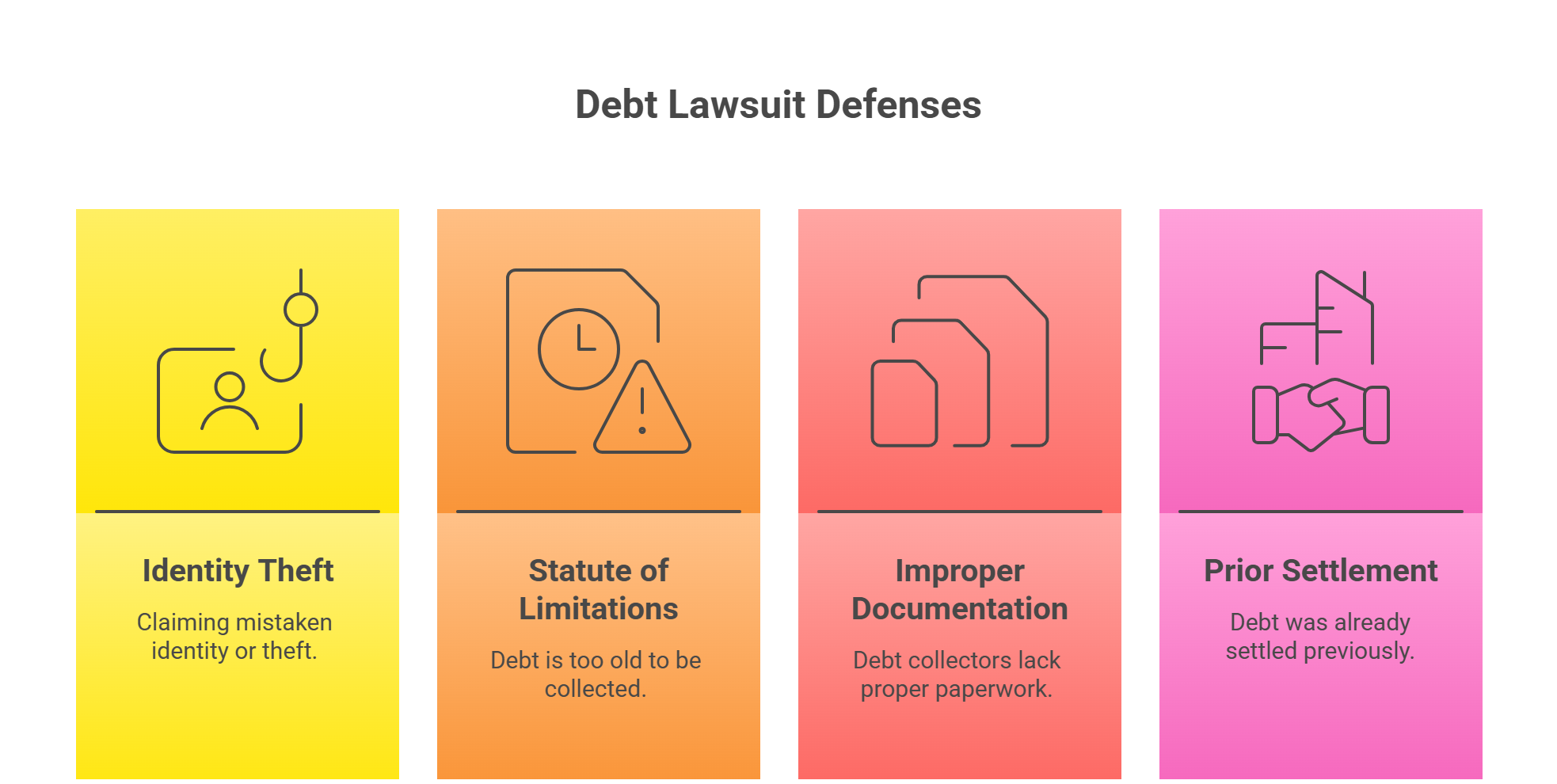

You should only fight the lawsuit if you can prove one of these defenses:

- Identity theft or mistaken identity

- Statute of limitations has expired (typically 5-15 years in Kentucky, depending on debt type)

- Improper documentation by debt collectors

- Settlement already reached, but not properly recorded

The "Do Nothing" Trap

Ignoring a lawsuit, hoping it disappears, creates the worst possible outcome. Kentucky courts regularly issue default judgments, giving creditors powerful collection tools, including the ability to freeze bank accounts and garnish wages immediately.

💡 Strategic Insight: Filing bankruptcy immediately after being served costs the same as filing after losing the lawsuit, but prevents months of legal fees, stress, and potential asset seizure.

Reach out to our bankruptcy lawyer in Bowling Green for tailored advice to your situation

What Happens If Someone You're Suing Files Bankruptcy

When someone you’re suing files for bankruptcy, your lawsuit faces immediate legal obstacles that can significantly impact your case.

1. Automatic Stay Halts Your Legal Action

The moment your defendant files for bankruptcy, federal automatic stay protection kicks in. Your lawsuit must stop immediately, regardless of how close you are to trial or judgment. Continuing legal action against someone in bankruptcy can result in court sanctions and penalties against you.

📋 Hypothetical Scenario: A Louisville business owner was days away from winning a $25,000 breach of contract judgment when the defendant filed Chapter 7 bankruptcy. The automatic stay immediately halted proceedings, and the business owner had to seek permission from the bankruptcy court to continue – a process that took four additional months.

2. Your Options When the Stay Takes Effect

You have three potential paths forward when an automatic stay stops your lawsuit:

- Seek Relief from Stay: You can file a motion with the bankruptcy court asking permission to continue your lawsuit in state court. Success depends on whether your claim involves fraud, willful misconduct, or other non-dischargeable debts.

- File a Proof of Claim: If your lawsuit involves money damages, you may need to file a claim in the bankruptcy case to recover any portion of what you’re owed.

- Wait for Discharge: In many cases, the debt underlying your lawsuit gets wiped out in bankruptcy, making continued litigation pointless.

⚖️ Strategic Consideration: Kentucky bankruptcy courts rarely grant relief from stay for simple contract disputes or negligence claims that can be discharged.

3. What Debts Survive Bankruptcy

Not all lawsuit claims get eliminated in bankruptcy. Your case may continue or restart after bankruptcy if it involves:

- Fraud or intentional misrepresentation

- Willful and malicious injury to a person or property

- Drunk driving injuries or death

- Embezzlement or breach of fiduciary duty

Recovery Reality: Even if you win a judgment on non-dischargeable debt, the debtor may still have limited assets or income to satisfy your claim.

Can You Sue Someone Who Filed Chapter 7 Bankruptcy

No, you generally cannot sue someone who filed Chapter 7 bankruptcy without first obtaining permission from the bankruptcy court. Federal automatic stay protection prevents new lawsuits against debtors during their bankruptcy case.

The Automatic Stay Barrier

The automatic stay protects debtors from new legal actions, not just existing ones. Violating the automatic stay by filing unauthorized lawsuits can result in:

- Contempt of court charges

- Monetary sanctions against you

- Attorney fee awards to the bankruptcy debtor

- Dismissal of your case

When New Lawsuits Are Permitted

Kentucky bankruptcy courts may allow new lawsuits in limited circumstances:

- Non-Dischargeable Debt Claims: Lawsuits alleging fraud, intentional torts, or other debts that survive bankruptcy may proceed with court permission.

- Property Recovery Actions: Cases seeking return of specific property (not money damages) sometimes get approval to continue.

- Family Court Matters: Child support, custody, and certain divorce proceedings can typically proceed without bankruptcy court permission.

The Adversary Proceeding Alternative

Instead of suing in state court, you may need to file an “adversary proceeding” within the bankruptcy case itself. This federal court process determines whether specific debts can be discharged.

Hypothetical Scenario: A Lexington contractor discovered a client filed Chapter 7 after completing $30,000 in renovations but before payment. Instead of filing a regular lawsuit, the contractor filed an adversary proceeding alleging the client fraudulently misrepresented their ability to pay, seeking to make the debt non-dischargeable.

Timing Considerations for Your Legal Strategy

- During Active Bankruptcy: New lawsuits typically require bankruptcy court permission and often get converted to adversary proceedings.

- After Discharge: You can sue for non-dischargeable debts, but discharged debts cannot be collected through litigation.

- After Case Closure: Normal state court litigation rules resume, but you cannot pursue discharged debts.

⚖️ Strategic Insight: Consider whether the time and expense of bankruptcy court proceedings justify your potential recovery, especially given the debtor’s limited financial resources.

If you’re considering legal action against someone in bankruptcy, consult with our experienced bankruptcy lawyer in Lexington, who understands both Kentucky state law and federal bankruptcy procedures.

Civil Lawsuit Bankruptcy Support in Kentucky

If you’re struggling financially and get hit with a lawsuit, consider speaking with one of our skilled Kentucky bankruptcy lawyers. We can help you stop the lawsuit in its tracks and sort out your debts.

Julie O’Bryan, our founding attorney, brings over 30 years of Kentucky bankruptcy experience to your case. She’s one of only six board-certified consumer bankruptcy attorneys in Kentucky – a distinction held by less than 1% of practicing lawyers.

Since establishing our family-owned firm in 1994, we’ve helped thousands of Kentucky families navigate complex debt situations. Our deep understanding of Kentucky bankruptcy courts in Louisville, Lexington, and Frankfort gives you strategic advantages other firms simply cannot provide.

If you have more questions, reach out to O’Bryan Law Offices today. We’ll schedule a free consultation with you where we’ll discuss your individual circumstances and the options available to you.

Call us at (502) 339-0222 or fill out our form.