Bankruptcy Lawyer in Owensboro, KY

Are endless collection calls, mounting medical bills, or threats of foreclosure disrupting your life?

Financial stress can be overwhelming, especially when creditors pursue garnishment or repossession. If you don’t act, it may only worsen.

Without taking action, your financial situation may continue to deteriorate. Creditors can pursue legal action, including judgments that allow them to garnish your wages or seize your assets. The stress of overwhelming debt affects your health, relationships, and overall quality of life.

O’Bryan Law Offices serves as your experienced bankruptcy lawyer in Owensboro, providing comprehensive debt relief solutions to our community. As a family-owned firm, we provide a comfortable environment and treat you with the one-on-one, respectful guidance you deserve.

Our founding attorney, Julie O’Bryan, established our firm nearly 30 years ago. We understand the sensitivity of your situation and assign an attorney and two paralegals to your case, all dedicated to providing the prompt, responsive guidance you need. With over 30 years of experience helping families achieve debt relief, we know what you’re going through.

Call (502) 339-0222 or contact us online today to schedule your free consultation—your path to peace of mind starts with one conversation.

A Brief Overview of Bankruptcy in Owensboro, KY

Bankruptcy represents a legal tool designed to provide debt relief, not a personal failure. This federal process allows individuals and businesses to eliminate or restructure overwhelming debt while protecting essential assets.

The U.S. Bankruptcy Court for the Western District of Kentucky in Owensboro handles all bankruptcy cases for Daviess County and surrounding areas. Additionally, the Daviess County Circuit Court provides information about local legal procedures that may affect your bankruptcy case, including state court judgments and garnishment orders that the automatic stay will address.

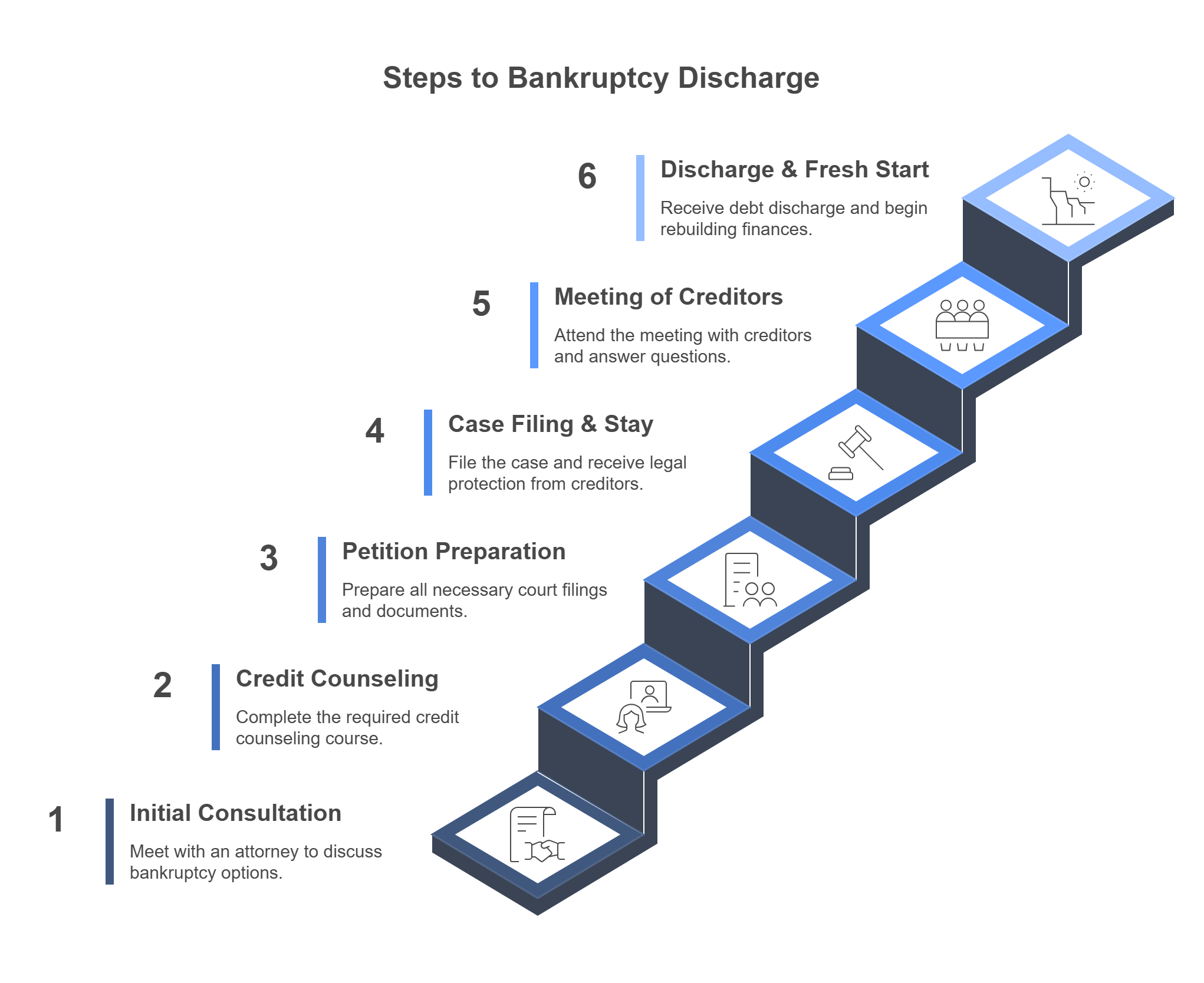

At O’Bryan Law Offices, we guide you through each step with clarity, compassion, and hands-on legal support. Here’s what you can expect when you work with us:

- Initial Consultation: You’ll meet directly with one of our attorneys—not just support staff—to review your finances and discuss whether Chapter 7 or Chapter 13 bankruptcy offers the best path forward.

- Credit Counseling: We’ll help you complete the required credit counseling course with a court-approved agency so you can move forward with confidence.

- Petition & Document Preparation: Our team prepares all court filings, schedules, and documentation for you, ensuring nothing is missed and minimizing delays.

- Case Filing & Automatic Stay: Once we file your case, you’ll receive immediate legal protection from creditor harassment, wage garnishment, and foreclosure thanks to the automatic stay.

- Meeting of Creditors: We’ll attend the 341 meeting with you and prepare you thoroughly so you feel confident answering the trustee’s questions.

- Discharge & Fresh Start: After your case concludes—usually in 3-4 months for Chapter 7 or 3-5 years for Chapter 13—you’ll receive a discharge of eligible debts and can begin rebuilding with a clean slate.

Understanding Kentucky bankruptcy laws ensures you maximize available protections and exemptions throughout this process.

What Bankruptcy Can & Cannot Do For You

Bankruptcy provides powerful debt relief tools while operating within specific legal limitations under federal and Kentucky state law.

| Bankruptcy CAN | Bankruptcy CANNOT |

|---|---|

| Stop foreclosure proceedings immediately through automatic stay | Eliminate child support or alimony obligations |

| End wage garnishments and creditor harassment | Discharge recent tax debts (typically less than 3 years old) |

| Eliminate credit card debt, medical bills, and personal loans | Remove student loans except in rare hardship cases |

| Discharge certain older tax debts (over 3 years old) | Eliminate court-ordered fines or criminal restitution |

| Protect exempt assets like primary residence and vehicle | Discharge debts incurred through fraud or intentional wrongdoing |

| Provide automatic stay protection from creditor collection | Remove secured debt liens (though you can surrender collateral) |

Federal bankruptcy law provides the framework, while Kentucky exemptions determine which assets you can protect. Learning when is it too late to stop foreclosure helps you understand the timing requirements for maximizing bankruptcy’s protective benefits.

Understanding both the pros and cons of filing for bankruptcy ensures you make an informed decision about this significant financial step. We are here to talk you through the process from start to finish.

Why Choose O'Bryan Law Offices as Your Bankruptcy Lawyer in Owensboro, KY?

With nearly 30 years of experience and more than 30,000 clients served across Kentucky and Indiana, O’Bryan Law Offices is a trusted name in consumer bankruptcy law.

Founding attorney Julie O’Bryan is one of only six board-certified consumer bankruptcy attorneys in Kentucky—a distinction awarded by the American Board of Certification to attorneys who demonstrate extensive experience, advanced legal education, and exceptional knowledge of bankruptcy law.

Here’s what sets our firm apart:

- Board-Certified Expertise: Julie O’Bryan has been board-certified since 2003, with a proven track record of success in complex bankruptcy cases.

- Attorney-Led Service: You’ll meet directly with an experienced attorney, not just staff, for real legal guidance from day one.

- Flat-Fee Pricing: Transparent, flat-fee billing means no surprise charges—ever.

- Responsive Support: We don’t use time clocks. Call us with questions, and you’ll get answers quickly.

- Convenience: Multiple office locations and experience in all Kentucky and Southern Indiana courts make the process smoother for you.

At O’Bryan Law Offices, we don’t believe in one-size-fits-all solutions. We take the time to understand your goals, explain your options clearly, and build a customized strategy that works for your life.

Restart. Rebuild. Restore your financial future—with guidance you can trust. Call us today at (502) 339-0222 or contact us online to schedule your free consultation with an experienced Owensboro bankruptcy attorney.

Do I Need an Owensboro Bankruptcy Lawyer?

While you aren’t required to hire bankruptcy attorneys for your case, we highly recommend at least scheduling a consultation. Our law firm offers free consultations, so we won’t add to the financial burdens you’re already struggling with.

Navigating bankruptcy court and the filing process can be confusing and stressful on your own. Let our bankruptcy attorney handle all the heavy lifting and paperwork for you.

Some individuals and businesses feel comfortable handling the process of bankruptcy on their own. However, the following are signs that you should consider speaking with a Kentucky bankruptcy lawyer.

- The paperwork and documents are too much to handle. Filing for bankruptcy involves a lot of paperwork and strict deadlines, regardless of which chapter you file. If you’re worried about filling out the forms correctly and submitting them on time, have an attorney help you. Attorneys who focus on bankruptcy will be well-acquainted with what you need for a successful case.

- Your creditors and debt collectors won’t stop harassing you. Creditor harassment is one of the main reasons why people end up filing for bankruptcy. When you work with a qualified bankruptcy lawyer, you can have them handle the creditors on your behalf.

- You don’t feel comfortable handling a court case alone. Representing yourself in court can be very stressful. However, working with an attorney can ensure that all of your legal needs are met and the filing process goes smoothly.

How Do I Find a Good Bankruptcy Attorney in Owensboro?

Once you decide to file for bankruptcy, we strongly recommend seeking qualified legal help. Rather than working with an attorney who splits their practice between family law, business law, and bankruptcy law, choose a firm that focuses primarily on bankruptcy. Our attorneys are well-equipped to answer your questions and provide you with quality representation.

Below, we outline how to identify a good attorney for your bankruptcy case.

Experience Matters

In any situation where you need legal aid, it’s important to choose an attorney who has extensive experience in their field. Rather than choosing an attorney who spreads their practice over multiple practice areas, choose one that focuses on bankruptcy. At O’Bryan Law Offices, we focus our efforts on helping consumers and businesses prepare for bankruptcy, file their cases, and rebuild their finances afterward.

Multiple Strategies and Options

Choose a firm that can lay out multiple options and adapt its strategy to your specific circumstances. Bankruptcy is not a one-size-fits-all situation. Each case requires personalized legal aid that will address the concerns of each business or client individually. Depending on the specific circumstances of your case, we will present multiple options for each client and help them determine the best course of action.

Preparation for Life

Not only do we provide quality legal help before and during bankruptcy, but we also give you the tools for success after your case. Our legal aid doesn’t end as soon as you receive your bankruptcy discharge. We will also give you advice on how to improve your credit score and how to achieve lasting debt relief.

Types of Bankruptcy: Chapter 7 vs. Chapter 13

The two primary consumer bankruptcy chapters serve different financial situations and goals:

| Feature | Chapter 7 | Chapter 13 |

|---|---|---|

| Duration | 3-4 months | 3-5 years |

| Income Requirement | Must pass means test | Must have regular income |

| Debt Relief | Most unsecured debt discharged | Partial repayment + discharge |

| Property Protection | May lose non-exempt assets | Keep all property while repaying |

| Co-Signer Protection | No protection for co-signers | Co-debtor stay protects co-signers |

| Best For | Low income, few assets | Regular income, want to keep home |

- Chapter 7 bankruptcy works best for individuals with limited income and few assets, providing a quick discharge of unsecured debts.

- Chapter 13 bankruptcy suits those with regular income who want to keep their home and other assets while repaying a portion of their debts over time.

💡 Our attorneys analyze your specific financial situation to recommend the most advantageous bankruptcy chapter for your circumstances.

Important Information From Our Owensboro Bankruptcy Attorneys

While this comprehensive information covers essential bankruptcy concepts, our attorneys provide personalized guidance on how these areas apply to your unique financial situation during your initial consultation.

Debts Dischargeable Through Bankruptcy

Dischargeable debts typically include:

- Credit card balances and personal loans

- Medical bills and hospital debt

- Past-due utility bills

- Certain older tax debts (over 3 years old)

- Personal guarantees on business debt

- Deficiency balances after vehicle repossession

- Old income tax debt meeting specific requirements

💡 Hypothetical Scenario: A family in western Kentucky faced $45,000 in medical debt after a serious car accident. Despite having health insurance, the remaining balance created overwhelming monthly payment obligations. Through Chapter 7 bankruptcy, they eliminated the entire medical debt burden and achieved their fresh start within four months.

Non-dischargeable debts generally include:

- Child support and alimony obligations

- Recent tax debts (less than 3 years old)

- Student loans (except rare hardship discharge)

- Court-ordered fines and criminal restitution

- Debt incurred through fraud or false pretenses

- Recent luxury purchases (over $725 within 90 days)

- Recent cash advances (over $1,000 within 70 days)

Our attorneys review each debt category with clients to ensure accurate categorization and strategic planning.

Protecting Your Assets: Exempt & Non-Exempt Property

Kentucky bankruptcy exemptions allow you to protect essential assets while filing for debt relief. These exemptions ensure you maintain basic necessities for your fresh start.

Kentucky exemptions include:

- $31,575 homestead exemption – protects equity in your primary residence

- $5,000 motor vehicle exemption – shields equity in your car or truck

- Unlimited retirement account protection – 401(k), IRA, and pension plans remain protected

- $7,500 personal property exemption – covers household goods, clothing, and tools of trade

- Insurance benefits – life insurance cash value and health insurance benefits

- Public benefits – Social Security, unemployment, and workers’ compensation

Understanding when do I have to surrender my vehicle in a Chapter 13 helps you plan strategically for asset protection.

📌 Strategic planning maximizes these exemptions to protect as much property as possible throughout the bankruptcy process.

Impact on Credit + Life After Bankruptcy

Bankruptcy affects your credit score, but provides the foundation for financial recovery. Chapter 7 bankruptcy remains on your credit report for 10 years, while Chapter 13 stays for 7 years from the filing date.

Credit rebuilding timeline:

- 6-12 months: Secured credit cards available

- 12-18 months: Auto loans at reasonable rates with steady income

- 18-24 months: FHA mortgage loans are possible with a good payment history

- 24-36 months: Conventional mortgage loans available

Many clients report increased employability after bankruptcy discharge because debt relief reduces financial stress and improves focus on career development. Employers cannot legally discriminate based on bankruptcy filing under federal law.

For residents of Owensboro seeking additional financial education resources, Kentucky Wesleyan College offers financial literacy programs that complement post-bankruptcy financial planning and long-term wealth-building strategies.

Automatic Stay Protection

The automatic stay takes effect immediately upon filing for bankruptcy, providing powerful protection from creditor collection activities. This federal court order legally prohibits most collection efforts.

The automatic stay halts:

- Creditor phone calls: Collection agencies must stop all contact immediately

- Wage garnishments: Employers receive notice to stop payroll deductions

- Lawsuits: Pending litigation gets suspended until bankruptcy resolution

- Foreclosure proceedings: Mortgage foreclosure sales get postponed indefinitely

- Vehicle repossession: Auto lenders cannot seize your car or truck

- Utility disconnections: Essential services continue during the bankruptcy case

✔️ Violations of the automatic stay result in court sanctions against creditors, including monetary penalties and attorney fees.

Co-Signers and Bankruptcy Implications

Understanding how bankruptcy affects co-signers protects important family relationships during the debt relief process.

- Chapter 7 bankruptcy does not protect co-signers – they remain liable for the full debt amount even after your discharge. This creates potential strain on family relationships and financial obligations.

- Chapter 13 bankruptcy provides co-debtor stay protection that prevents creditors from pursuing co-signers while you make plan payments. This protection extends throughout your repayment period, typically 3-5 years.

💡 Hypothetical Scenario: A small business owner in Daviess County accrued $78,000 in credit card debt while trying to keep their storefront open during a downturn. A family member had co-signed one of the major business credit lines. Filing for Chapter 13 bankruptcy allowed the owner to repay just $23,000 over five years, protecting both their business assets and their co-signer from collections or lawsuits.

Learning does bankruptcy affect a spouse helps married couples structure their cases to minimize family financial disruption. Our attorneys structure bankruptcy cases strategically to minimize impact on family members and preserve important relationships.

Employment Considerations

Federal law under Section 525 of the Bankruptcy Code prohibits employment discrimination based on bankruptcy filing. Employers cannot legally fire current employees or refuse to hire job applicants solely because of bankruptcy history.

Protected employment rights include:

- Current employers cannot terminate for bankruptcy filing

- Government agencies cannot deny employment based on bankruptcy

- Professional licensing boards cannot revoke licenses for bankruptcy

- Security clearance decisions must consider rehabilitation efforts

The Equal Employment Opportunity Commission enforces these protections and investigates discrimination complaints.

Timeline of the Bankruptcy Process

Understanding bankruptcy timelines helps you plan effectively for the legal process and debt relief outcome.

Chapter 7 timeline typically spans 90-120 days:

- Filing to meeting of creditors: 30-45 days

- Meeting of creditors to discharge: 60-75 days

- Total process completion: 3-4 months

Chapter 13 timeline extends 36-60 months:

- Plan confirmation: 30-60 days after filing

- Monthly plan payments: 3-5 years

- Final discharge: Upon completion of all payments

Our firm’s experience minimizes delays by ensuring complete, accurate documentation and proactive communication with trustees and creditors.

Costs Associated With Filing for Bankruptcy in Owensboro

Bankruptcy costs vary based on case complexity and chosen chapter, but these representative figures help with financial planning:

| Expense | Chapter 7 | Chapter 13 |

|---|---|---|

| Court Filing Fee | $338 | $313 |

| Attorney Fees (typical) | $1,500-$2,500 | $4,500-$4,750 |

| Credit Counseling | ~$15 | ~$15 |

| Debtor Education | ~$15 | ~$15 |

| Total Estimated Cost | $1,868-$2,868 | $4,843-$5,093 |

⚖️ Payment plans are available to help manage legal fees, and many clients use their Chapter 7 filing fee as their final major expense before achieving debt-free status.

Individuals facing overwhelming medical debt can also explore financial assistance programs. Owensboro Health Regional Hospital provides financial counseling services and payment plan options for patients experiencing difficulty with medical bills, which can help determine whether bankruptcy is necessary or if alternative payment arrangements might resolve the situation.

Alternatives to Bankruptcy

Our attorneys provide honest assessments of all debt relief options, recommending bankruptcy only when it serves your best interests.

- Debt consolidation combines multiple debts into a single monthly payment, often at lower interest rates. This works best for manageable debt levels with steady income.

- Debt negotiation involves settling debts for less than the full amount owed. Success depends on creditor cooperation and available lump-sum payments.

- Debt management plans through credit counseling agencies provide structured repayment over 3-5 years. These programs require full debt repayment without legal protection.

Understanding debt settlement pros and cons and why you should never pay a collection agency protects you from potentially harmful financial decisions.

📌 Bankruptcy often provides more comprehensive relief with stronger legal protections compared to these alternatives.

Contact a Owensboro Bankruptcy Lawyer at O'Bryan Law Offices Today

Don’t let overwhelming debt continue to disrupt your life and jeopardize your family’s financial future. The stress of collection calls, wage garnishment, or the risk of foreclosure doesn’t have to define your path forward—real relief is possible.

At O’Bryan Law Offices, our board-certified bankruptcy attorney and experienced legal team have helped thousands of Kentucky families find lasting debt solutions through Chapter 7 and Chapter 13 bankruptcy. We’re proud to bring over 30 years of focused experience to Owensboro residents seeking a fresh financial start.

Our firm and attorneys are recognized by trusted legal directories, including Avvo (where Julie O’Bryan holds a “Superb” rating), Super Lawyers, and Justia. These distinctions reflect our commitment to excellence and trusted service throughout Kentucky and Indiana.

Unlike unregulated debt relief companies that often overpromise and underdeliver, our attorneys use the full protection of the U.S. Bankruptcy Code to help you reduce or eliminate your debt, with transparency, legal oversight, and a clear path forward.

Call (502) 339-0222 or contact us online to schedule your free consultation. Take the first step toward peace of mind and lasting debt relief—with guidance you can trust.

FAQs

Do I need to include my spouse in my bankruptcy filing?

No, you can file for bankruptcy individually even if you’re married. However, if you live in Kentucky and have joint debts or joint assets, your spouse’s income may be considered in the means test calculation for Chapter 7 eligibility.

What happens to my tax refund if I file bankruptcy?

Tax refunds received after filing may be considered part of your bankruptcy estate. The timing of your filing relative to tax season can affect whether you keep your refund, making strategic timing important.

Can I file bankruptcy if I'm unemployed or on disability?

Yes, unemployment or disability income doesn’t prevent you from filing for bankruptcy. Having limited income may make you more likely to qualify for Chapter 7, and disability benefits are typically protected from creditors.

Will filing bankruptcy affect my security clearance or professional license?

Bankruptcy alone rarely results in loss of security clearance or professional licensing. However, you must disclose the filing as required, and agencies consider your overall financial responsibility and honesty in reporting.

How soon can I buy a house after bankruptcy discharge?

FHA loans may be available 2 years after Chapter 7 discharge or 1 year into a Chapter 13 payment plan with court approval. Conventional loans typically require 2-4 years with rebuilt credit and stable income.