Bankruptcy Lawyer in Nicholasville, KY

Are you struggling with overwhelming debt that keeps you awake at night? Do creditor calls disrupt your daily life, leaving you stressed and anxious about your financial future? Many Nicholasville residents face these exact challenges, and without taking action, the consequences can be devastating—wage garnishments, foreclosure, and damaged credit that follows you for years.

You don’t have to face this financial crisis alone. O’Bryan Law Offices, your trusted Nicholasville bankruptcy lawyer, provides compassionate legal guidance to help you regain control of your financial life. Our experienced bankruptcy attorneys have helped over 30,000 families across KY find relief through strategic debt solutions.

We understand that every case is unique and requires personalized attention. Our board-certified expertise and 30 years of experience help families throughout Kentucky and Indiana find the relief they need to move forward with confidence.

Call us today at (502) 339-0222 or reach out through our contact form to schedule your free consultation. Let’s talk about your goals, your worries, and how we can help you move forward with confidence.

A Brief Overview of Bankruptcy in Nicholasville, KY

Bankruptcy is a legal tool designed to provide financial relief, not a personal failure. Federal bankruptcy law operates through the Eastern District of Kentucky Bankruptcy Court, which serves Jessamine County and surrounding areas, including Nicholasville. Local residents can also access community support through the Jessamine County Government and various county services.

At O’Bryan Law Offices, we guide you through the bankruptcy process with clarity and compassion, protecting you from creditors while helping you choose the best path forward for your unique financial situation.

Here’s how the bankruptcy process works:

- Initial consultation: Meet with our experienced bankruptcy lawyer to assess your financial situation and determine if bankruptcy is right for you.

- Case preparation: Gather required financial documents and complete mandatory credit counseling through an approved agency.

- Filing petition: Submit your bankruptcy petition to the Eastern District of Kentucky Bankruptcy Court with all supporting documentation.

- Automatic stay: Creditor harassment, wage garnishments, and collection activities stop immediately upon filing.

- Meeting of creditors: Attend a brief meeting with the trustee to answer questions about your financial situation under oath.

- Discharge: Receive your discharge order, eliminating qualifying debts and providing you with a fresh financial start.

📌 This process follows Kentucky bankruptcy laws and provides robust protection for residents facing financial hardship.

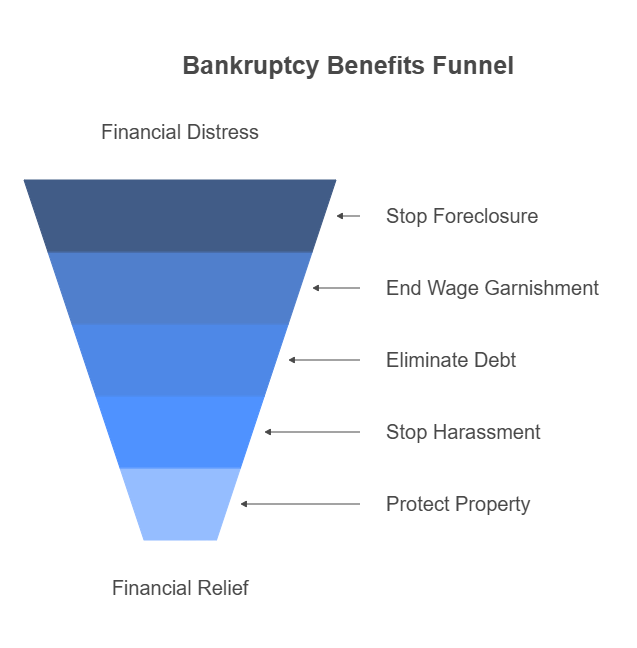

What Bankruptcy Can & Cannot Do For You

Understanding the scope of bankruptcy protection helps you make informed decisions about your financial future. Here’s what bankruptcy can and cannot accomplish:

What Bankruptcy CAN Do:

- Stop foreclosure proceedings: Chapter 13 allows you to catch up on missed mortgage payments over time

- End wage garnishment: Automatic stay protection halts all collection activities immediately

- Eliminate credit card debt: Most unsecured debts are discharged completely

- Discharge medical bills: Hospital and medical debts are typically eliminated

- Stop creditor harassment: No more collection calls or threatening letters

- Protect exempt property: Keep your home, car, and essential belongings

Understanding when is it too late to stop foreclosure can help you take timely action to protect your home.

💡 Hypothetical Scenario 2: A single parent burdened by $25,000 in medical debt after their child’s emergency surgery turned to Chapter 7 bankruptcy. This eliminated the entire debt load, giving them the freedom to focus on their family, not creditors.

What Bankruptcy CANNOT Do:

- Eliminate child support or alimony: These obligations survive bankruptcy

- Discharge student loans: Federal student loans require extreme hardship to discharge

- Remove recent tax debts: Recent income taxes and penalties typically cannot be discharged

- Eliminate court-ordered fines: Criminal fines and restitution remain due

The interplay between federal and Kentucky state laws affects how these protections apply to your specific situation. Our knowledgeable team helps you understand the pros and cons of filing for bankruptcy before making this important decision.

When Should I Call a Bankruptcy Attorney in Nicholasville?

When you feel like you have done everything imaginable to solve your financial problems and you’re not succeeding, it may be time to call an experienced Kentucky bankruptcy attorney. If you are facing any of the following financial problems, they may be strong indicators that it may be time to consult our knowledgeable attorney:

- If you find yourself unable to meet your monthly obligations

- Receiving constant calls from debt collectors

- Experiencing little cash flow

- Have written “hot” checks

If you are unable to repay your debts and qualify, a bankruptcy attorney at O’Bryan Law Offices can help you get a fresh start on your financial future. Call (502) 339-0222 or contact us online today to schedule your free consultation.

Why Choose O'Bryan Law Offices as Your Bankruptcy Lawyer in Nicholasville, KY?

As a family-owned firm, we provide a comfortable environment and treat you with the one-on-one, respectful guidance you deserve. Founded by Julie O’Bryan nearly 30 years ago, we’ve built our reputation on providing personalized attention and achieving successful outcomes for families throughout Kentucky and Indiana.

What sets us apart:

- Board-certified expertise: Julie O’Bryan is board-certified in consumer bankruptcy by The American Board of Certification and has been certified since 2003, making her one of only three board-certified consumer bankruptcy lawyers in Louisville and one of only six in Kentucky

- Recognized excellence: Julie O’Bryan has been recognized by Super Lawyers, and O’Bryan Law Offices maintains an exceptional reputation in the legal community

- Maximum peer rating: Julie holds the “Superb” rating on Avvo, the highest possible peer review rating, and is profiled on Justia for her legal expertise

- 30 years of proven results: We’ve helped countless families across KY and IN achieve financial freedom

- Personalized service: When you choose us, we assign an attorney and two paralegals to your case, all dedicated to providing prompt, responsive guidance

- Multiple convenient locations: Offices in Louisville, Frankfort, and New Albany make us accessible to Nicholasville residents

- Flat-fee billing: We’ve thrown out the time clocks, so you never have to worry about paying for quick questions – everything is billed on a flat-fee basis agreed to in advance

Our team understands that filing for bankruptcy can feel overwhelming, but you don’t have to go through this process alone. We provide professional legal guidance every step of the way, ensuring you understand your options and feel confident in your decisions.

Types of Bankruptcy: Chapter 7 vs. Chapter 13

Choosing the right type of bankruptcy depends on your income, assets, and financial goals. Here’s a comprehensive comparison:

| Feature | Chapter 7 | Chapter 13 |

|---|---|---|

| Duration | 3-4 months | 3-5 years |

| Income Qualification | Must pass means test | Must have regular income |

| Debt Relief | Most unsecured debt discharged | Partial repayment + discharge |

| Property Protection | May lose non-exempt assets | Keep assets while repaying |

| Co-Signer Protection | No protection | Yes, co-debtor stay applies |

| Foreclosure Relief | Temporary delay | Can cure arrearages |

Chapter 7 bankruptcy is most suitable for individuals with limited income who qualify for the means test. This “fresh start” option eliminates most unsecured debts quickly, allowing you to rebuild your financial foundation.

Chapter 13 bankruptcy creates a manageable repayment plan for individuals with steady income who want to keep their assets. This option is ideal for homeowners facing foreclosure or individuals with significant non-exempt property.

✔️ Our experienced attorneys help you determine which chapter best serves your needs based on your unique financial situation and goals.

Important Information From Our Nicholasville Bankruptcy Attorneys

Filing for bankruptcy involves many complex legal considerations. While this information provides a solid foundation, our team will walk you through how these areas specifically apply to your case during your consultation.

Debts Dischargeable Through Bankruptcy

Typically dischargeable debts include:

- Credit card balances and store cards

- Medical bills and hospital debt

- Personal loans and payday loans

- Utility bills and past-due rent

- Business debts and commercial loans

- Old income tax debts (over 3 years old)

Non-dischargeable debts include:

- Child support and alimony obligations

- Most student loans

- Recent tax debts and penalties

- Court-ordered fines and restitution

- Debts from fraud or willful misconduct

✔️ We carefully review each debt type with you to ensure you understand which obligations will be eliminated and which will remain after discharge.

Protecting Your Assets: Exempt & Non-Exempt Property

Kentucky law provides generous exemptions to protect your essential property during bankruptcy. Understanding these protections helps you keep what matters most.

Kentucky bankruptcy exemptions include:

- Homestead exemption: $31,575 in home equity protection

- Vehicle exemption: $5,000 in car equity protection

- Personal property: Household goods, clothing, and personal effects

- Retirement accounts: 401(k), IRA, and pension plans are fully protected

- Tools of trade: Work equipment and professional tools

- Wildcard exemption: Additional protection for any property

Our strategic planning helps maximize your exemptions and protect as much property as possible. We know exactly how to structure your case to ensure you get the best possible outcome while complying with Kentucky and federal law.

Understanding queries such as, when do I have to surrender my vehicle in a Chapter 13, helps you make informed decisions about keeping your transportation.

Impact on Credit + Life After Bankruptcy

Filing for bankruptcy will impact your credit score for 7-10 years, but many clients begin rebuilding their credit within 12-24 months. The key is taking proactive steps immediately after discharge.

Credit rebuilding strategies include:

- Secured credit cards to establish payment history

- Auto loans often available within 2-3 years

- Mortgage loans possible within 2-4 years with good payment history

- Focus on paying all bills on time consistently

💡 Many clients find that bankruptcy actually improves their employability by eliminating debt stress and allowing them to focus on career advancement. Employers cannot legally discriminate based on bankruptcy filings.

Automatic Stay Protection

The automatic stay is one of bankruptcy’s most powerful protections, taking effect immediately upon filing your petition. This federal court order prohibits creditors from taking any collection actions.

The automatic stay halts:

- Creditor phone calls: Collection agencies must stop contacting you immediately

- Wage garnishments: Payroll deductions cease, allowing you to keep your full paycheck

- Lawsuits: Pending litigation is suspended while your case proceeds

- Foreclosure proceedings: Mortgage lenders cannot continue foreclosure sales

- Repossession attempts: Vehicle and personal property seizures are prohibited

- Utility shutoffs: Essential services cannot be disconnected for past-due amounts

This protection provides immediate relief and breathing room to address your financial situation properly.

Co-Signers and Bankruptcy Implications

When you’re struggling with debt, it’s not just your finances at stake—your co-signers and family members may also be impacted. Understanding how bankruptcy affects them is key to protecting the people you care about.

Chapter 7: While it can wipe out your personal liability for certain debts, co-signers are not protected. Creditors can still pursue them for the full balance, even after your discharge. This often creates tension or financial strain within families, especially if the co-signer was unaware or unprepared for the responsibility.

Chapter 13: This chapter includes a co-debtor stay, which legally prevents creditors from pursuing co-signers on consumer debts while you make payments under your court-approved plan. It provides valuable breathing room for both you and your co-signer, often preserving important relationships during difficult times.

💡 Our attorneys help structure your bankruptcy strategically, considering how to protect spouses, co-signers, and family finances. Questions like does bankruptcy affect a spouse are common, and we offer clear, practical answers to help you move forward with confidence.

Employment Considerations

Federal law Section 525 protects bankruptcy filers from employment discrimination. Employers cannot legally fire, refuse to hire, or discriminate against employees based on bankruptcy filings.

Additional Kentucky protections include:

- Government employers cannot consider bankruptcy in hiring decisions

- Professional licenses typically remain unaffected

- Security clearances may require disclosure, but rarely result in denial

- Bankruptcy can actually improve job performance by reducing financial stress

These protections ensure that seeking debt relief won’t jeopardize your career or professional standing. For additional employment resources and support, residents can connect with local institutions like the University of Kentucky and Transylvania University, which offer continuing education and career development programs.

Timeline of the Bankruptcy Process

Understanding the bankruptcy timeline helps you plan ahead and reduces the stress of uncertainty. At O’Bryan Law Offices, we keep your case on track from start to finish by anticipating key milestones and avoiding common delays.

Chapter 7 Timeline

- Filing to 341 Meeting (Meeting of Creditors): 30–45 days after filing

- Discharge Order Issued: 60–90 days after the 341 meeting

- Total Duration: Typically 90–120 days from start to finish

Chapter 7 is often the fastest and most straightforward path to eliminating unsecured debt—ideal for clients with limited income and few assets. Most clients never appear in court beyond the brief 341 meeting.

Chapter 13 Timeline

- Filing to Plan Confirmation Hearing: 60–90 days

- Monthly Plan Payments: 3–5 years based on income and repayment capacity

- Final Discharge: Upon successful completion of all plan payments

Chapter 13 gives you time to catch up on mortgage arrears, vehicle loans, or tax debts while keeping your assets. Our team helps you develop a realistic plan that meets court approval and fits your financial reality.

With over 30 years of experience, our attorneys ensure that every step of your case is handled with precision, helping you avoid costly errors and move forward with confidence.

Costs Associated With Filing for Bankruptcy in Nicholasville

Bankruptcy costs vary depending on your case complexity and the chosen chapter. These figures provide general guidance, though actual costs may differ based on your situation:

| Expense | Chapter 7 | Chapter 13 |

|---|---|---|

| Court Filing Fee | $338 | $313 |

| Attorney Fees (typical) | $1,500-$2,500 | $4,500-$4,750 |

| Credit Counseling | ~$15 | ~$15 |

| Debtor Education | ~$15 | ~$15 |

We offer flexible payment plans to make quality legal representation affordable for families facing financial hardship. Unlike other firms, you will meet with an attorney for your initial consultation, and you can retain our firm by making a $300 payment toward your legal fees. Our transparent fee structure ensures no surprise costs throughout your case.

Alternatives to Bankruptcy

We believe in providing honest assessments and won’t recommend bankruptcy unless it’s truly your best option. Sometimes, alternative solutions better serve your needs:

- Debt consolidation combines multiple debts into a single payment with potentially lower interest rates. This works well for individuals with good credit and manageable debt levels.

- Debt negotiation involves negotiating with creditors to reduce balances or payment terms. Success depends on creditor cooperation and your ability to make lump-sum payments.

- Debt management plans work with credit counseling agencies to create structured repayment schedules. These plans require consistent income and creditor participation.

⚖️ Understanding debt settlement pros and cons and why you should never pay a collection agency helps you make informed decisions about your options.

Contact a Nicholasville Bankruptcy Lawyer at O'Bryan Law Offices Today

Don’t let overwhelming debt control your life any longer. Our compassionate team understands the challenges you’re facing and provides the professional legal guidance you need to achieve financial freedom.

Your financial future doesn’t have to be defined by past struggles. Our experienced team has extensive experience helping Nicholasville residents and Jessamine County families establish their best path forward through strategic bankruptcy planning.

If you’re considering bankruptcy, you’ve found the right law firm to guide you through this challenge. Our knowledgeable attorneys recognize that every step of this process requires careful attention to detail and personalized service.

Call (502) 339-0222 today or contact us online to schedule your free “Fresh Start Planning Session” — let’s talk about how we can help you leave debt behind and take back control of your future.

FAQs

Will I lose my car if I file for bankruptcy?

Not necessarily. Kentucky’s vehicle exemption protects $5,000 in car equity, and many clients keep their vehicles. If you’re current on payments and the car has minimal equity, you can usually continue making payments and retain your vehicle.

How soon can I buy a house after bankruptcy?

Most clients can qualify for an FHA mortgage 2-3 years after Chapter 7 discharge or 1-2 years after Chapter 13 completion, provided they maintain good payment history and stable employment during the waiting period.

Can I keep my retirement accounts in bankruptcy?

Yes, retirement accounts like 401(k)s, IRAs, and pension plans are fully protected in bankruptcy under federal law. These accounts cannot be touched by creditors or the bankruptcy trustee, ensuring your future financial security remains intact.

What happens to my tax refund during bankruptcy?

Tax refunds may be considered part of your bankruptcy estate, depending on when you file. The trustee may claim all or part of your refund, so timing your filing strategically can help protect this money.

Do I have to appear in court for my bankruptcy case?

You’ll attend a brief “Meeting of Creditors” with the trustee, which typically lasts 5-10 minutes and occurs outside the courtroom. Most cases don’t require formal court appearances before a judge unless complications arise.