How to File Bankruptcy Chapter 7 in Kentucky

Filing for Chapter 7 bankruptcy in Kentucky can provide a clear path toward eliminating overwhelming debt and starting fresh. If you’re struggling with credit card balances, medical bills, or other

Filing for Chapter 7 bankruptcy in Kentucky can provide a clear path toward eliminating overwhelming debt and starting fresh. If you’re struggling with credit card balances, medical bills, or other

Are debt collectors flooding your phone with calls and filling your mailbox with threatening letters? You’re not alone, and more importantly, you have legal protections that many collectors hope you

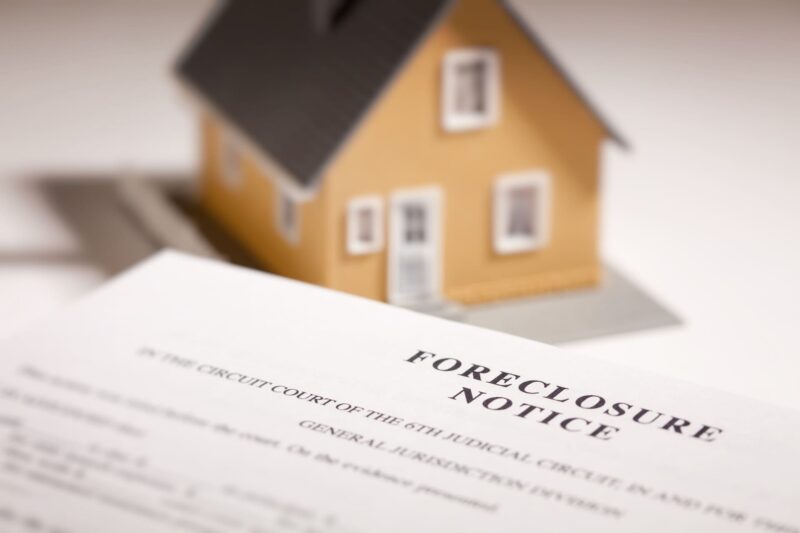

Facing foreclosure can feel like the ground is crumbling beneath your feet. You’re not alone—thousands of Kentucky homeowners find themselves in this situation each year, and there are real solutions

If you’re worried about your vehicle being repossessed, you’re likely asking: can a repo man come on private property? The short answer is yes, but only under certain circumstances and

Chapter 13 bankruptcy, often called the “wage earner’s plan,” allows individuals with regular income to create a court-approved repayment plan lasting three to five years. Rather than liquidating assets, you

Filing for Chapter 7 bankruptcy in Kentucky requires careful attention to your tax obligations. Many filers don’t realize that tax returns play a critical role throughout the bankruptcy process, from

Financial stress affects thousands of Kentucky families each year. Medical bills pile up, credit card debt grows, and unexpected job losses can make it feel like there’s no way out.

Are you drowning in debt with no clear path forward? Filing for bankruptcy in Kentucky might be an option worth considering. Bankruptcy is a legal process that can provide relief

Filing bankruptcy in Kentucky generally does not directly affect your spouse unless you have joint debts or assets. Your spouse’s separate property and credit score remain protected if you file

An adversary proceeding is a separate lawsuit within a bankruptcy case that addresses disputes requiring court intervention. Governed by Bankruptcy Rule 7001 and sections 523, 727, 547, and 548 of

Bankruptcy is a complicated process, and it can be quite invasive. It requires the petitioner to reveal all of their assets and debts to have those debts resolved. In exchange

Bankruptcy can provide financial relief for many adults with large amounts of debt. Filing bankruptcy can help people get a handle on their financial situation and get back to living

If you’re in a financial bind and looking for solutions, you may have run across the term “consumer proposal.” While it is a valid alternative to bankruptcy, it is not

Table of Contents Filing bankruptcy is considered a tough break in the eyes of the average person. It has a negative, even scary financial connotation. While it’s true that bankruptcy

A motion for relief from stay, sometimes called a motion to lift stay, is a formal request a creditor makes during a bankruptcy case. By filing this motion, the creditor

Disclaimer: The use of the internet or this form for communication with the firm or any individual member of the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.