Danville KY Bankruptcy Lawyer: Chapter 7

The Path to Financial Freedom Starts Here With Our Bankruptcy Lawyer in Danville

Are you drowning in debt in Danville, KY? Do you need an experienced bankruptcy attorney to help navigate your particular situation?

Many Danville residents face overwhelming financial challenges each year. O’Bryan Law Offices can provide the assistance you need to effectively address your debt concerns and seek a fresh start.

With our competent representation, we’ll help determine if filing for bankruptcy is your best option based on your unique circumstances.

📞 Call us today at (502) 339-0222 to schedule a free consultation with our dedicated bankruptcy lawyer in Danville.

Understanding Bankruptcy in Danville, Kentucky

Bankruptcy allows individuals and businesses to eliminate or reorganize debts under court protection. For Danville residents, this legal process offers a legitimate path to financial recovery.

The law provides options for debtors to regain control and create a more secure future.

Bankruptcy cases for Danville residents are processed through the United States Bankruptcy Court for the Eastern District of Kentucky, which handles all bankruptcy matters in Central Kentucky.

⚖️ According to data from the Administrative Office of the U.S. Courts, Boyle County’s bankruptcy rate follows Kentucky’s pattern of being higher than the national average. This reflects the economic pressures facing Danville residents, including the area’s healthcare costs and regional employment fluctuations.

What Bankruptcy Can and Cannot Do

What it can do:

- Stop foreclosure on your Danville property

- Eliminate wage garnishments

- Discharge credit card and medical debt

- Halt creditor harassment

- Wipe out certain older tax obligations

What it can’t do:

- Remove property liens

- Erase child support or alimony

- Discharge most student loans

- Eliminate recent tax debts or court fines

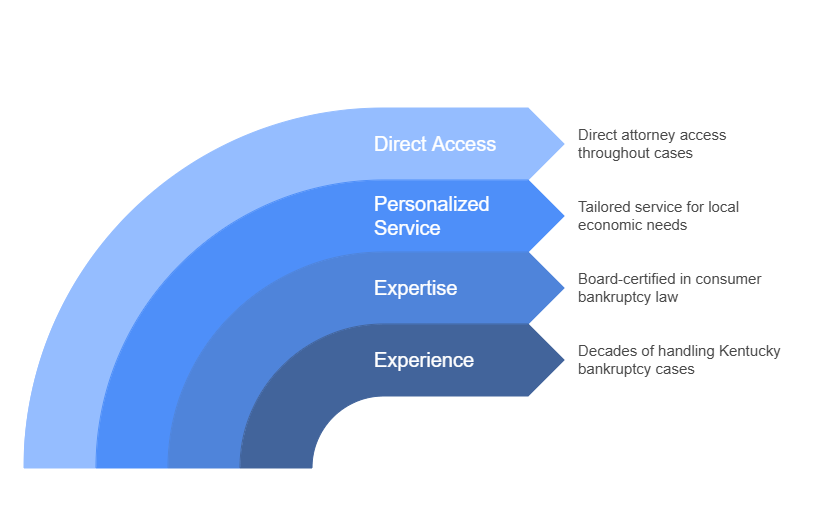

Why Choose Our Danville Bankruptcy Law Firm?

- Decades of experience handling Kentucky bankruptcy cases

- Board-certified expertise in consumer bankruptcy law

- Personalized service for Danville’s economic considerations

- Direct attorney access throughout your case

✨ Our firm offers the advantage of specialized bankruptcy certification that few Kentucky attorneys possess—a significant benefit when navigating the complexities of federal bankruptcy law.

Attorney Julie O’Bryan will handle your bankruptcy case personally, providing the dedication you need during this challenging time. Unlike a general practice attorney who may occasionally take on bankruptcy matters, we dedicate our practice to helping clients overcome financial struggles.

Types of Bankruptcy: Chapter 7 vs. Chapter 13

| Feature | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) |

|---|---|---|

| Timeline | 3–4 months | 3–5 year repayment plan |

| Income Requirements | Must pass means test | Requires stable income |

| Debt Resolution | Most unsecured debt eliminated | Partial repayment with remaining discharge |

| Property Risk | Non-exempt assets may be liquidated | Retain all property while paying |

| Foreclosure Protection | Temporary pause | Creates path to save your home |

| Co-Signer Impact | Co-signers remain liable | Offers co-debtor stay protection |

| Credit Report Impact | 10 years | 7 years |

Chapter 7 bankruptcy allows you to quickly eliminate most unsecured debts within 3-4 months. To qualify for this type of bankruptcy, your income must fall below Boyle County’s median household income or you must pass the “means test.”

Chapter 13 bankruptcy creates a 3-5 year court-approved payment plan. This option lets you keep valuable assets while catching up on secured debts like your mortgage.

🏠 Danville’s historic districts like Broadway and Lexington Avenue feature homes that often carry significant equity, making Chapter 13 bankruptcy an important consideration for many local homeowners. The Boyle County Property Valuation Administrator reports steady appreciation in Danville’s housing market, affecting bankruptcy options available to residents.

Debts Dischargeable Through Bankruptcy

Bankruptcy effectively eliminates most unsecured debts including:

- Credit card balances from financial institutions

- Medical bills from Ephraim McDowell Regional Medical Center

- Personal loans

- Utility payments to Kentucky Utilities

- Certain older tax debts

However, bankruptcy cannot eliminate obligations such as:

- Child support ordered by Boyle County Family Court

- Alimony payments

- Recent tax liabilities

- Most student loans

- Court-ordered restitution

- Debts from fraudulent actions

💼 Danville’s position as a healthcare hub with Ephraim McDowell Health means medical debt is a significant factor in local bankruptcy filings.

Protecting Your Assets: Exempt and Non-Exempt Property

Kentucky homeowners can protect up to $31,575 in home equity during bankruptcy. This exemption amount will protect many Danville properties, allowing residents to file for bankruptcy without risking their primary residence.

State law also provides exemptions for:

- Up to $5,000 in vehicle equity

- Reasonable household furnishings

- Clothing and health aids

- Tools needed for your occupation

With proper planning, most bankruptcy filers in Danville can retain all their important assets while still receiving debt relief.

Hypothetical Scenario: Protecting Home Equity in Danville

🔍 Hypothetical Scenario: An Ephraim McDowell healthcare worker owns a historic home in downtown Danville worth $240,000 with a mortgage balance of $170,000, creating $70,000 in equity. This amount exceeds Kentucky’s $31,575 homestead exemption.

After consulting with a bankruptcy attorney, the individual chooses Chapter 13 bankruptcy rather than Chapter 7, allowing them to protect their entire equity while creating an affordable repayment plan for $45,000 in credit card and medical debt.

Impact of Bankruptcy on Credit and Future Financial Opportunities

Chapter 7 bankruptcy remains on credit reports for 10 years, while Chapter 13 appears for 7 years. Many clients see credit improvement within months if their scores were already damaged by late payments or collections.

Most Danville residents qualify for:

- Secured credit cards within 3-6 months post-discharge

- Auto financing within 12-24 months

- Mortgage eligibility within 2-4 years

While bankruptcy may impact employment in Danville’s financial sector, federal law prohibits hiring discrimination based solely on bankruptcy status.

Exploring Alternatives to Bankruptcy

Before deciding to file, consider these alternatives:

Combines multiple debts into a single loan, potentially lowering interest rates. Local credit unions offer these loans to members with good credit, but this doesn’t reduce the principal amount owed.

Involves working directly with creditors to reduce balances. While this can succeed with smaller local creditors, it typically requires substantial lump-sum payments.

Credit counseling agencies, including Kentucky Legal Aid, offer management programs with reduced interest rates. These programs typically involve 3-5 year commitments.

🔄 These alternatives often prove insufficient for substantial debt. We provide honest advice about all options, recommending bankruptcy only when it’s truly your best path forward.

Need to quickly address overwhelming debt? Contact our office at (502) 339-0222 for a free consultation.

Costs Associated with Filing for Bankruptcy

Court filing fees in Kentucky:

- Chapter 7: $338

- Chapter 13: $313

Attorney fees depend on case complexity, with additional costs include credit counseling (approximately $15) and credit reports.

| Expense | Chapter 7 | Chapter 13 |

|---|---|---|

| Court Filing Fee | $338 | $313 |

| Credit Counseling | ~$15 | ~$15 |

| Credit Reports | $30-$50 | $30-$50 |

For those concerned about the amount they’ll need to pay upfront, O’Bryan Law Offices offers flexible payment arrangements.

Automatic Stay: Halting Creditor Actions

The automatic stay activates immediately when you file for bankruptcy, prohibiting creditors from:

- Collection calls

- Wage garnishments

- Foreclosure proceedings

- Vehicle repossession

- Utility disconnections

This protection creates essential breathing room to address your financial challenges without creditor pressure.

⚡ The automatic stay remains effective throughout your bankruptcy case—typically 3-4 months for Chapter 7 or 3-5 years for Chapter 13 matters.

Hypothetical Scenario: Automatic Stay Stopping Collection Actions

🔍 Hypothetical Scenario: A Centre College employee faced multiple collection lawsuits in Boyle County District Court after accumulating debt during a prolonged illness. With wage garnishment about to begin, they sought legal help.

They were able to file their Chapter 7 bankruptcy within 48 hours, immediately stopping all collection actions. The automatic stay prevented the garnishment of their wages and halted all pending court cases against them.

For specialized bankruptcy assistance, contact O’Bryan Law Offices at (502) 339-0222. We dedicate ourselves to helping Danville residents find debt relief through competent legal representation.

Co-Signers and Bankruptcy Implications

In Chapter 7 bankruptcy, your personal liability for debts is discharged, but co-signers remain responsible. Once your case is filed, creditors may shift collection efforts to those co-signers.

Chapter 13 provides added protection through a “co-debtor stay,” which temporarily stops creditors from pursuing co-signers as long as your repayment plan is active—an important safeguard for family members who helped you secure credit.

Our attorneys will work with you to develop a strategy that protects both your interests and those of your co-signers throughout the process.

Duration of the Bankruptcy Process

Takes approximately 3-4 months from filing to discharge. The process begins with submitting your petition, followed by a 341 meeting of creditors about 30 days later, with discharge typically 60-90 days after this meeting.

Spans 3-5 years based on income and repayment terms. Payments to the trustee begin within 30 days, with confirmation hearings within 1-3 months.

🕒 Our familiarity with Eastern District procedures helps ensure your case progresses efficiently toward financial recovery.

Employment Considerations Related to Bankruptcy

Federal bankruptcy law prohibits both public employers and private companies from terminating employment or discriminating against employees solely for filing bankruptcy.

Government entities cannot consider bankruptcy in hiring decisions. Private employers have more discretion, particularly for financial positions, though most focus on current stability rather than past challenges.

For Danville residents working at major employers like Ephraim McDowell Health, American Greetings, or Centre College, bankruptcy typically has minimal employment impact.

Our Commitment to Danville Clients

Unlike larger full-service law firms that handle everything from business law to criminal law, we commit our practice to bankruptcy and related financial matters. This specialization allows us to offer superior representation for Danville residents in bankruptcy court.

Our focused approach ensures you receive representation from attorneys who deal with bankruptcy cases every day, providing the expertise needed to navigate complex financial situations effectively.

Contact Our Danville Bankruptcy Lawyer Today For a Free Consultation

Taking the first step toward financial renewal can feel overwhelming, but you don’t need to face this dispute alone. O’Bryan Law Offices provides experienced representation in all bankruptcy practice areas.

Our attorneys will evaluate your financial situation, explain all bankruptcy options, and determine whether filing is right for you. During your free consultation, we’ll answer every question and outline a clear path forward.

With offices serving all of Kentucky, our lawyers regularly assist clients throughout Boyle County. Contact our office at (502)339-0222 to schedule your confidential consultation.

🏠 The sooner you reach out, the sooner we can help stop creditor harassment, protect your Danville property, and begin your journey toward financial freedom.

FAQs About Bankruptcy in Danville, Kentucky

In most cases, no. Kentucky’s homestead exemption protects up to $31,575 in home equity—sufficient for many Danville properties. For higher equity levels, Chapter 13 allows you to keep your home while catching up on mortgage payments.

Yes. The automatic stay immediately halts all wage garnishments upon filing—whether you work at Ephraim McDowell Health, Centre College, or any other local employer.

Bankruptcy remains on your credit report for 7-10 years but most clients begin rebuilding credit within months. Many qualify for auto financing within 1-2 years and mortgages within 2-4 years.

Most unsecured debts including credit cards, medical bills, personal loans, and utility arrears. Non-dischargeable debts include child support, alimony, recent taxes, most student loans, court fines, and fraudulent debts.

Qualification depends on the “means test,” comparing your income to Boyle County’s median income. If your income falls below this threshold, you automatically qualify; if above, we analyze your disposable income after living expenses.

Yes, we provide services for bankruptcy, personal injury cases, uncontested divorces, and estate planning. Our attorneys navigate these complex intersections, ensuring coordinated representation across all your legal needs.