Table of Contents

When a person or a company files for bankruptcy with the bankruptcy court, their repaid debts go to a specific creditor’s claim (or multiple creditor claims) as well as various shareholders and equity holders. The order in which these creditors receive payments, as well as how much they receive, all depends on the Absolute Priority Rule within bankruptcy law. An experienced bankruptcy attorney at O’Bryan Law Offices will walk you through the Absolute Priority Rule throughout your bankruptcy process and ensure that all creditors and shareholders receive an appropriate payment. Call us today at 502-339-0222 for a free consultation.

What is the Absolute Priority Rule (APR) in Bankruptcy?

The Absolute Priority Rule (APR) is also called the “liquidation preference.” Basically, it’s a rule that determines how much money that creditors receive from debtors. In a business bankruptcy, this rule determines the portion of payment that will be made to each partner. Creditors’ debts will be paid first, and then other shareholders will receive whatever is left of the remaining assets. This rule plays a role in individual bankruptcy as well. Generally, secured claims have priority over unsecured claims. This means that secured claims usually receive the most money and they receive it first.

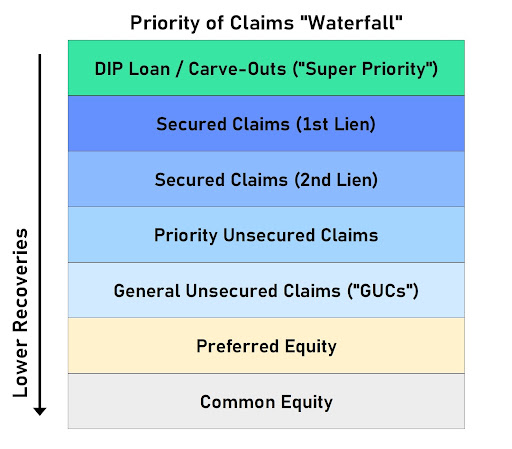

Priority of Claims Hierarchy

Claim priority depends on a multitude of factors, including loan timing, collateral interests, senior or subordinated status, etc. Listed below is the priority of claims from most to least important. The ones towards the top are senior creditors, and they generally receive the most money from debtors. Meanwhile, the ones towards the bottom receive the least amount of money from debtors, if any at all.

- Debtor-in-possession (DIP) loan

- 1st lien secured claims

- 2nd lien secured claims

- Priority unsecured claims

- General unsecured creditors (GUCs)

- Preferred equity

- Common equity

To learn more about the priority of claims hierarchy, we recommend reading about what a subordination agreement is and how it can affect you.

How the Absolute Priority Rule Works

Under the Absolute Priority Rule, the claims towards the bottom of the aforementioned hierarchy should not receive any money from the debtor until the claims towards the top received full recovery. Based on this process, the claims at the bottom often receive little to no money. This hierarchy is a “fair and equitable” treatment plan for creditors according to the U.S. Bankruptcy Code.

Secured Creditors vs. Unsecured Creditors

While looking at that hierarchy, you may be asking yourself: what’s the difference between secured creditors and unsecured creditors? What makes them superior or inferior to each other? In short, secured creditors are also called senior creditors because they have the highest priority and the lowest risk when it comes to repaid debt. Unsecured creditors are also called junior creditors because they have the lowest priority and the highest risk when it comes to repaid debt.

Secured Creditor

Basically, secured creditors (or senior creditors) issue loans to borrowers that are backed by collateral. The collateral is what makes it secure. Collateral is any valuable asset, such as a house or a piece of property, that protects the lender if the borrower isn’t able to pay off their debt. If this happens, the lender can simply seize the collateral in order to regain some or all of their money back. Many types of entities can be secured creditors, such as:

- A real estate mortgage holder

- Banks with liens on various assets

- Statutory lien holders

- Equipment lender

- Receivables lender

Unsecured Creditor

Unsecured creditors (or junior creditors) are basically the opposite of secured ones. They lend money to borrowers without asking for collateral in return. Unsecured credit is extremely high risk for the creditor because if the debtor can’t pay them back, then they have nothing to fall back on. If these creditors want to confiscate a debtor’s assets, they must first win a lawsuit. Additionally, a debtor who fails to pay their unsecured creditor will likely suffer from a low credit score. They will also struggle to obtain unsecured credit in the future. Common unsecured creditors include:

- Credit card companies

- Landlords

- Doctor’s offices and hospitals

- Lenders who give out personal or student loans

Unsecured Priority Claims vs. GUCs

As you can see in the hierarchy of claims above, unsecured priority claims are ranked first followed by general unsecured creditors (GUCs). The difference between the two is that the former aren’t dischargeable during a bankruptcy case and if remaining funds are available after secured creditors get paid, then it will go to these claims. Priority unsecured claims generally include alimony, child support, priority tax claims, and personal injury or wrongful death claims caused by drunk driving.

Meanwhile, GUCs are dischargeable during bankruptcy proceedings except for student loans. All priority claims must receive payment before GUCs receive anything. In certain circumstances, GUCs may receive a very small amount of debt payments. But most times, there’s hardly any money left over for other creditors at the bottom of the Absolute Priority Rule hierarchy. Common examples of GUCs include credit card debt, medical expenses, and personal loans.

Bankruptcy Code Parameters for Creditor Classes

So, how does the Bankruptcy Code determine the specific creditor classes? Firstly, the Bankruptcy Code splits claims into the following categories:

- The Creditor’s Right to Receive Payment, or

- The Right to a Fair Remedy for Post-Performance Failure

But the debt reorganization plan still must rank and classify creditors so as to not violate the Absolute Priority Rule. The parameters for assigning claims and creditors to specific classes are listed below.

- All claims in a group must have “substantial” commonalities that are unique to the class.

- A well-thought-out “business judgment” must underpin any classification decision.

These classes ensure fair and equitable treatment within the Absolute Priority Rule.

Is the Absolute Priority Rule Mandatory in Chapter 7 and Chapter 11?

Yes, the Absolute Priority Rule is mandatory in both Chapter 7 and Chapter 11 bankruptcy cases. If the debtor undergoes liquidation in Chapter 7 proceeding, the trustee must ensure that all sales money goes to the correct creditors as according to the Absolute Priority Rule. Meanwhile in a Chapter 11 proceeding, a reorganization plan plus a disclosure statement generally restructures and categorizes debtor claims into specific classes.

Call Bankruptcy Attorneys at O’Bryan Law Today

Bankruptcy attorneys at O’Bryan Law Offices have over 40 years of combined experience in financial management and successful bankruptcy proceedings. Additionally, we are experts in ensuring the Absolute Priority Rule isn’t violated during Chapter 7 and Chapter 11 proceedings. For more information on how we can help you with all things financial freedom, call us today at 502-339-0222.