Table of Contents

Many Americans don’t have the option or ability to buy a car with cash. Although using cash is a simpler process, most people have to finance their new vehicles. However, if you’re new to buying a car, the process can feel quite daunting. Maybe you’ve wondered, “What credit score is needed to buy a car?”

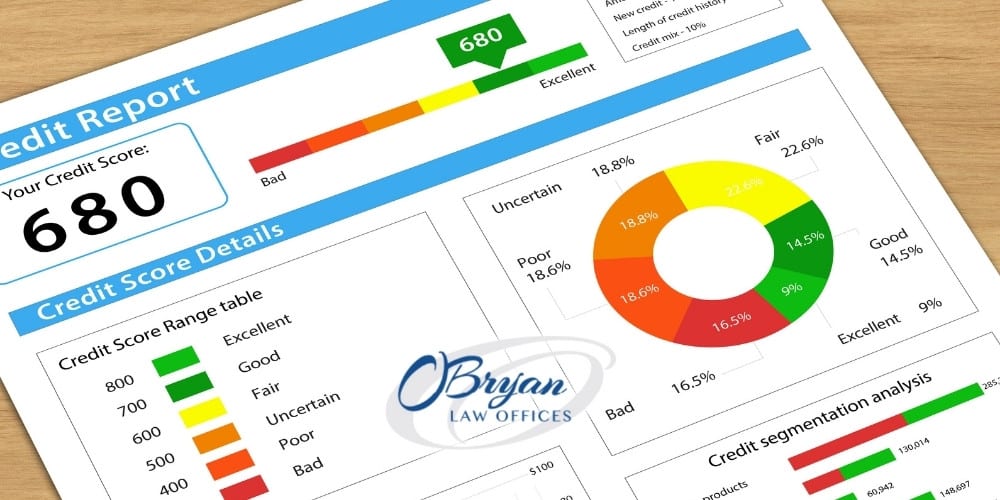

Credit scores are a way for auto lenders to assess your eligibility for an auto loan, as well as to determine what your loan terms, interest rates, and monthly payments will be. While a higher credit score is generally more favorable in terms of your interest rate, it is still possible to qualify for a loan with a lower score. If you’re unsure of how to proceed when shopping around for a car, it’s a good idea to speak with a credit counseling professional. At O’Bryan Law Offices, we not only have Louisville bankruptcy attorneys. We also have qualified professionals who can help you improve your credit score and make auto loans more affordable. To schedule a free consultation with us, please call 502-339-0222 today.

Understanding Auto Loan Credit Scores

It’s no secret that credit scores are widely used by multiple lenders for a wide variety of purposes. Maybe you’re trying to buy a car, and you need an auto loan. Or maybe you need something else, such as a home loan or credit card. No matter what kind of credit you need, having a good credit score is preferable to having a bad credit score.

This is because your score basically paints a picture of how much risk you might pose to a particular creditor. Even if you’re a very responsible person, poor credit can severely hurt your chances of approval for credit. But what exactly goes into determining your credit score anyway?

Your credit score is based on these five factors.

- Payment history (35%)

- Credit utilization/amount owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- Recent credit activity and new credit accounts (10%)

Auto Loan Tiers Based on Credit Scores

There are 5 tiers of car loan rates: super prime, prime, nonprime, subprime, and deep subprime.

- Super Prime rates are reserved for those with credit scores between 781-850.

- Prime rates are for those with a FICO auto score between 661-780.

- Nonprime rates are for those with a credit score between 600-660.

- Subprime rates are for those with a credit score between 600-500.

- Deep subprime rates are for those with scores between 300-500.

Generally, super prime has the lowest interest rate, while deep subprime has the highest interest rate.

What Credit Scoring Model Do Car Dealers Use?

There are two main credit scoring models: FICO score and VantageScore. FICO stands for Fair Isaac Corporation. Most auto lenders use the FICO Auto Score. The FICO score has a range of 250 to 900. Therefore, the credit score that you see on your personal credit report may differ from what an auto lender may see. The FICO auto score usually differs at least a little from your credit report, as it takes into account certain risks that your regular credit reports do not.

Is There a Minimum Credit Score to Get a Car Loan?

Technically, there is no minimum credit score needed for an auto loan. However, the lower your credit score, the higher your interest rate and vice versa. If you have poor credit, potential lenders take this to mean that you’re a risky borrower. Therefore, they raise interest rates as a means of protecting themselves from financial losses.

Conversely, having a good credit score shows responsibility in terms of your monthly payments. Because lenders perceive higher credit scores as financial responsibility, those with good credit are rewarded with a lower interest rate. As an example, a subprime borrower might have an interest rate above 10%, while a super prime borrower might have a rate as low as 3%.

So, is 600 a good credit score to buy a car? It really depends on the kinds of rates you want. If you can afford to wait a bit and build your score, it may be worth your while.

Is There a Minimum Credit Score Required for Buying a Car?

Again, there is not a set minimum credit rating required to buy a car or get a car loan. You can buy a car with a lower credit score, but be ready to see a higher average interest rate. However, some lenders are picky about who they’ll loan to. Many lenders of auto loans look for borrowers in the prime or super prime ranges.

How Does Your Credit Score Impact Your Car Loan?

The three major credit bureaus are Equifax, Experian, and TransUnion. These bureaus provide you with your credit reports. However, lenders also have access to these reports, as they can request a hard credit check. Lenders use your average credit scores to determine both your interest rate and your monthly payment. They may also impact your down payment. Usually, those with a low credit score will be asked to give a larger down payment than those with high scores.

Average Interest Rates Based on Credit Score Ranges

According to Experian, the average auto loan APR for new cars is 4.07%. The average car loan APR for used cars is 8.62%. Below, we outline the average interest rates for each FICO Auto Scores range.

| Credit Score Range | Average APR for a New Car | Average APR for a Used Car |

| Super prime | 2.40% | 3.71% |

| Prime | 3.56% | 5.58% |

| Nonprime | 6.70% | 10.84% |

| Subprime | 10.87% | 17.29% |

| Deep subprime | 14.76% | 20.99% |

How Does Your Credit Score Impact Your Car Insurance Premiums?

Another concern you might have while car shopping is your car insurance premiums. Your credit score is important even in this regard, as it plays a role in determining your rates. Again, higher credit scores usually get better rates. Lower credit scores usually have more expensive premiums. For some people, poor credit scores can increase their car insurance premiums by nearly double.

What Credit Score Do You Need to Buy a Car?

So, what is the minimum score needed for a car purchase or a car loan? This mostly depends on what your personal goals are. If you’re looking for a lower monthly payment and an interest rate under 10%, you’ll likely need a score of 661 or higher to achieve these goals. Also, keep in mind that a used car loan often has a higher interest rate than a new car loan. However, those with lower scores still have options. We’ll go over those options in detail later.

How Can I Improve My Credit Score Before Applying for a Car Loan?

If you’re gearing up to buy a car, there are a few ways to boost your credit score before applying for car loans. Below, we list some of the most effective ways to keep track of your credit and raise your score for better auto financing rates.

- Regularly check your credit report and scores. If you see any significant risk factors, try to focus on those first. Also, make sure all the information on your credit reports is accurate. If not, call the appropriate credit bureau to get the mistake corrected.

- Always make on-time payments. Your payment history is the largest factor in determining your score. One way to ensure that you make your payments on time is to set up automatic payments.

- Pay down your credit card balances and maintain a favorable ratio between your balance and your credit limits.

Can You Get a Car Loan With Bad Credit?

Absolutely. However, your terms might be very unfavorable. You might end up facing interest rates of 20% or more, which can greatly increase the amount you pay for a vehicle. For example, let’s say you want to buy a car that costs $50,000. If you pay an interest rate of 20%, you’ll end up paying $10,000 more for a total of $60,000.

In contrast, let’s look at an interest rate of 5%. For a $50,000 car, you’d only end up paying $2,500 more for a total of $52,500. That’s a large jump. But if you need a car, you need a car. So let’s explore some ways you can make buying a car with low credit less costly and frustrating.

- First and foremost, check your budget to see what payments you can afford. Add in the estimated costs that come along with owning a car, such as fuel costs, maintenance, and car insurance.

- Monitor your credit score. If you have some time to buy a car, use that time to build your score. A credit counseling attorney with O’Bryan Law Offices can help you achieve a higher credit score to buy a vehicle.

- Save up for a larger down payment. If you save up for a down payment, it will likely help your loan eligibility. Additionally, larger down payments can help you get lower interest rates.

- Shop around different lenders before making a decision. Sometimes, simply having an existing relationship with a bank or credit union can help you. Other potential lenders include online car loans and car dealerships.

Contact O’Bryan Law Offices for Tips on How to Improve Your Credit

All in all, there is no minimum score that you need to buy a used or new car. You can buy a car with any level of credit. However, building up a good credit score can greatly help you in many ways other than just car shopping. If you’re struggling to build a high enough credit score to open up more opportunities for your finances, we’re here for you. O’Bryan Law Offices is a debt relief agency dedicated to helping Kentucky and Indiana residents regain control of their finances. To schedule a free consultation with us, please call 502-339-0222 today.

If you already have a vehicle, but you’re struggling to make your payments, you may have a lien placed on your vehicle. In our related blog, we discuss the common question of “What is a lien on a car?” and how you can remove that lien.